FitPocket

My role

UI/UX Designer leading the project from conception to delivery

Tools

- Figma

- Adobe Photoshop

- Adobe Illustrator

- Miro

- Maze

My role

Tools

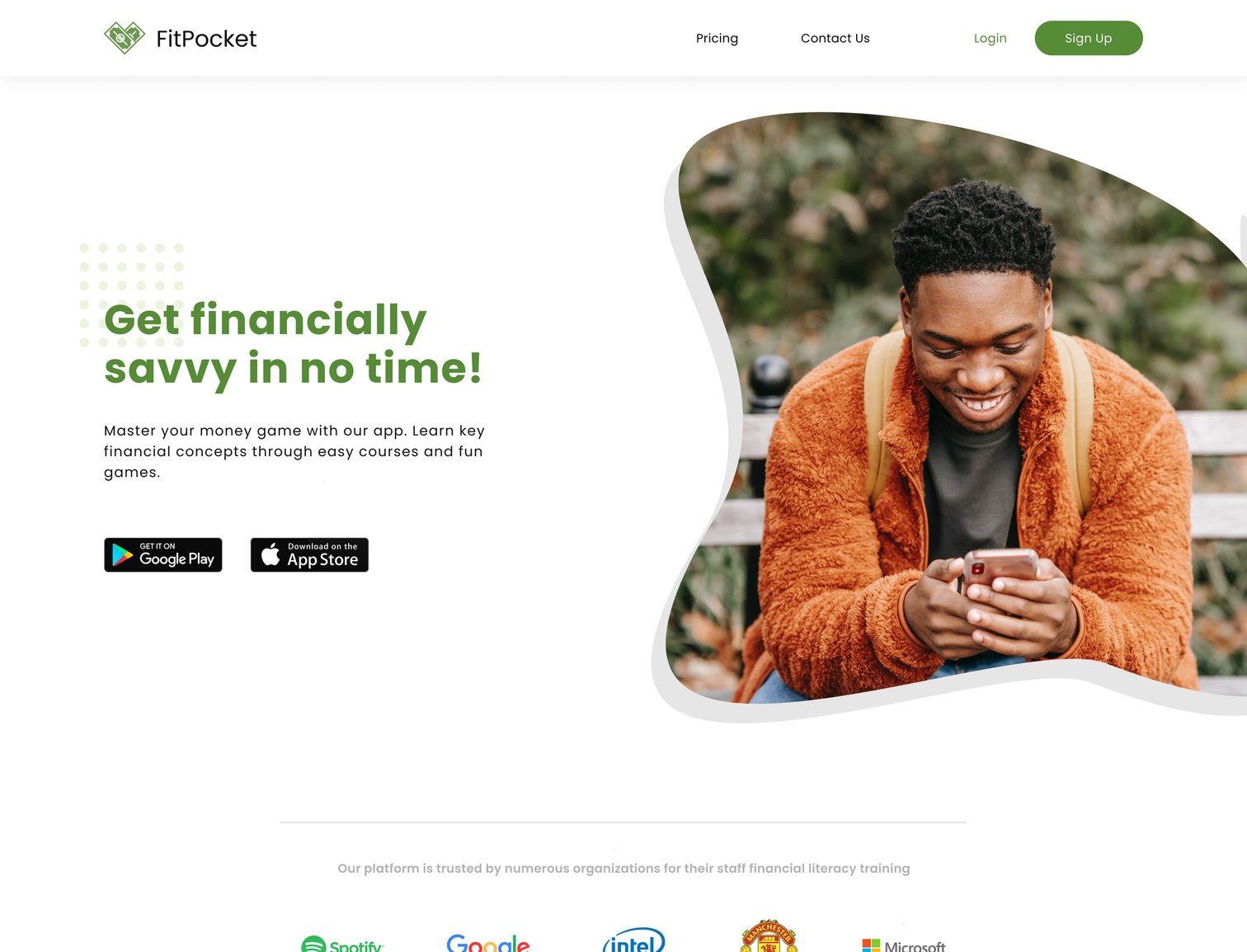

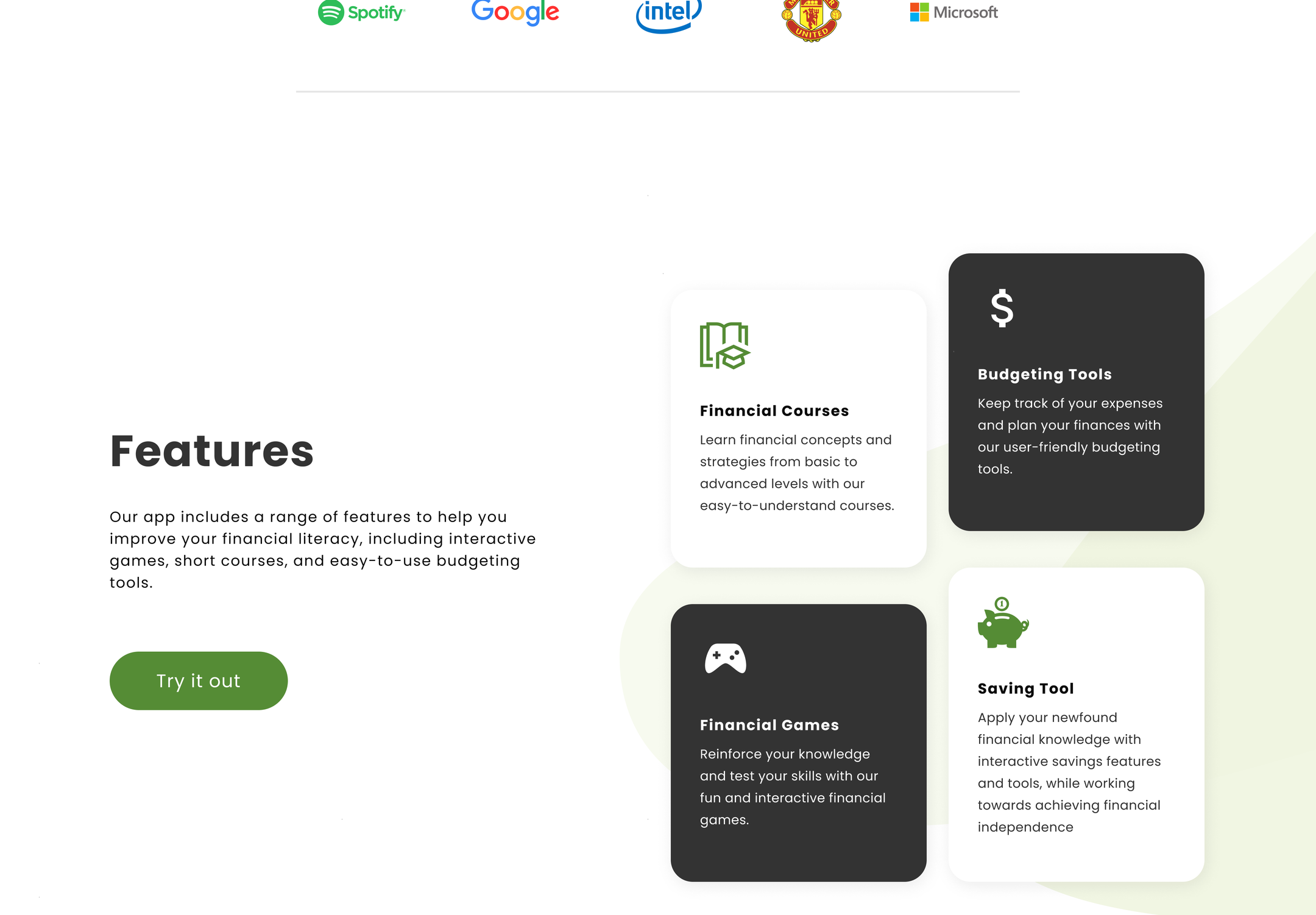

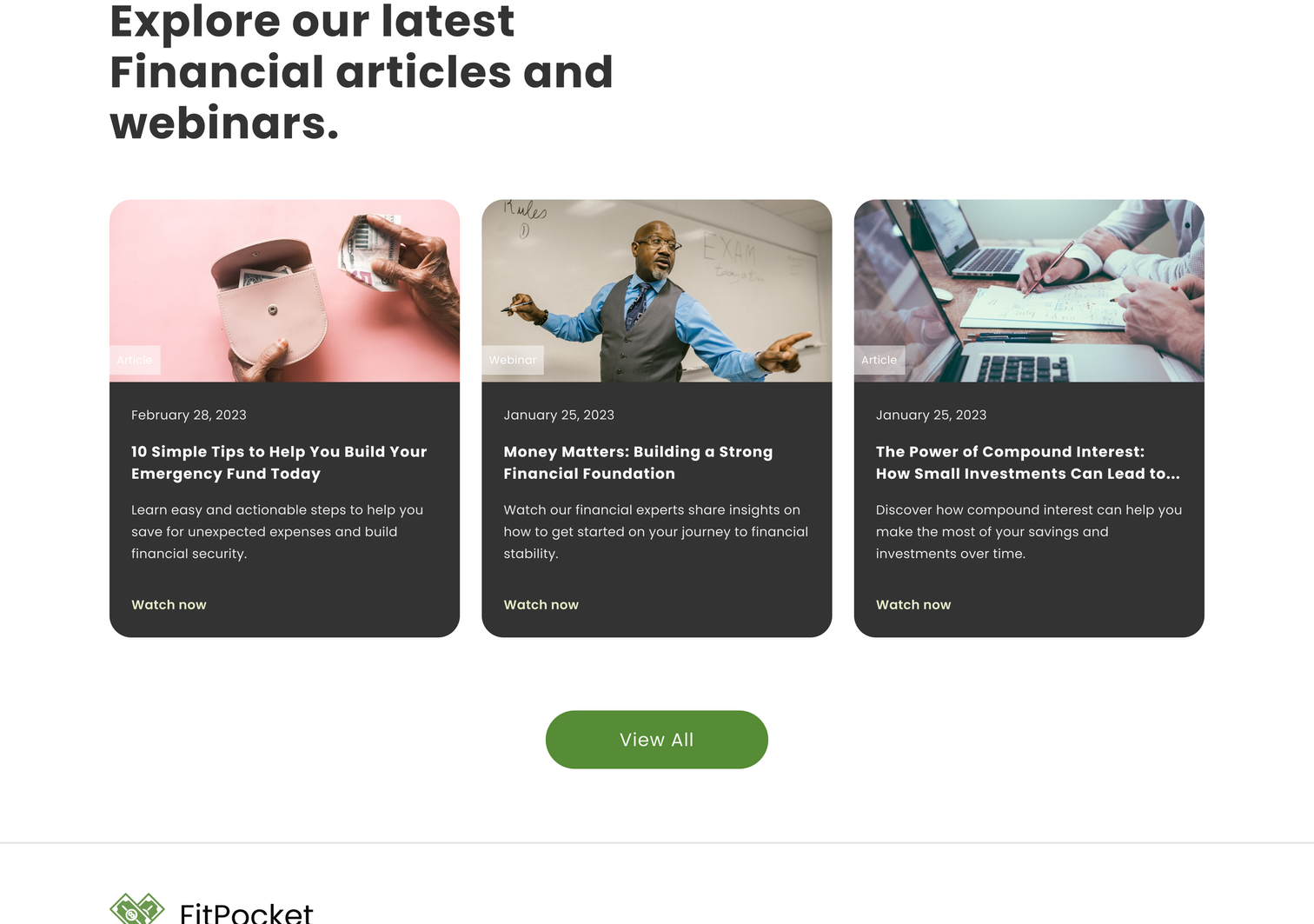

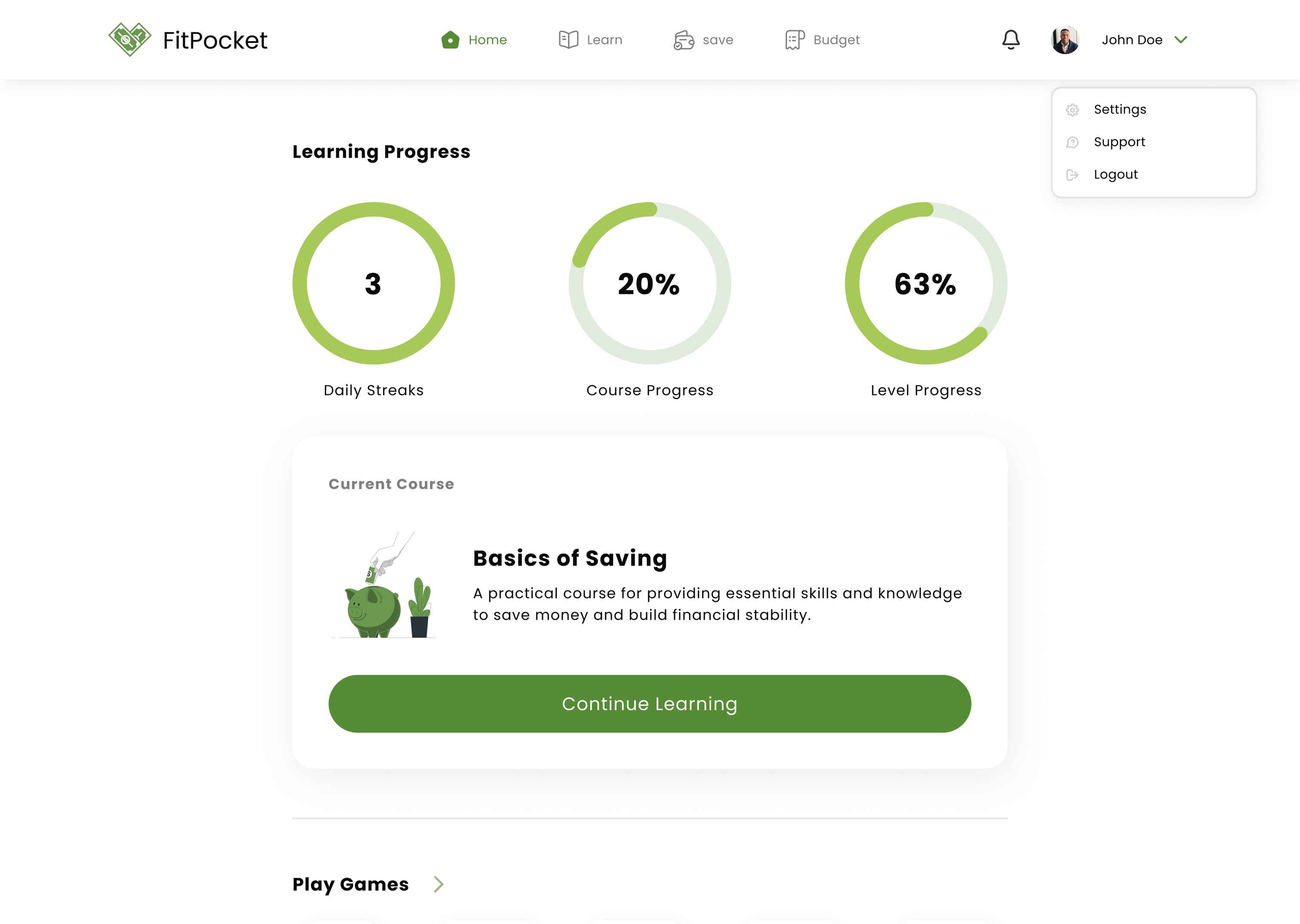

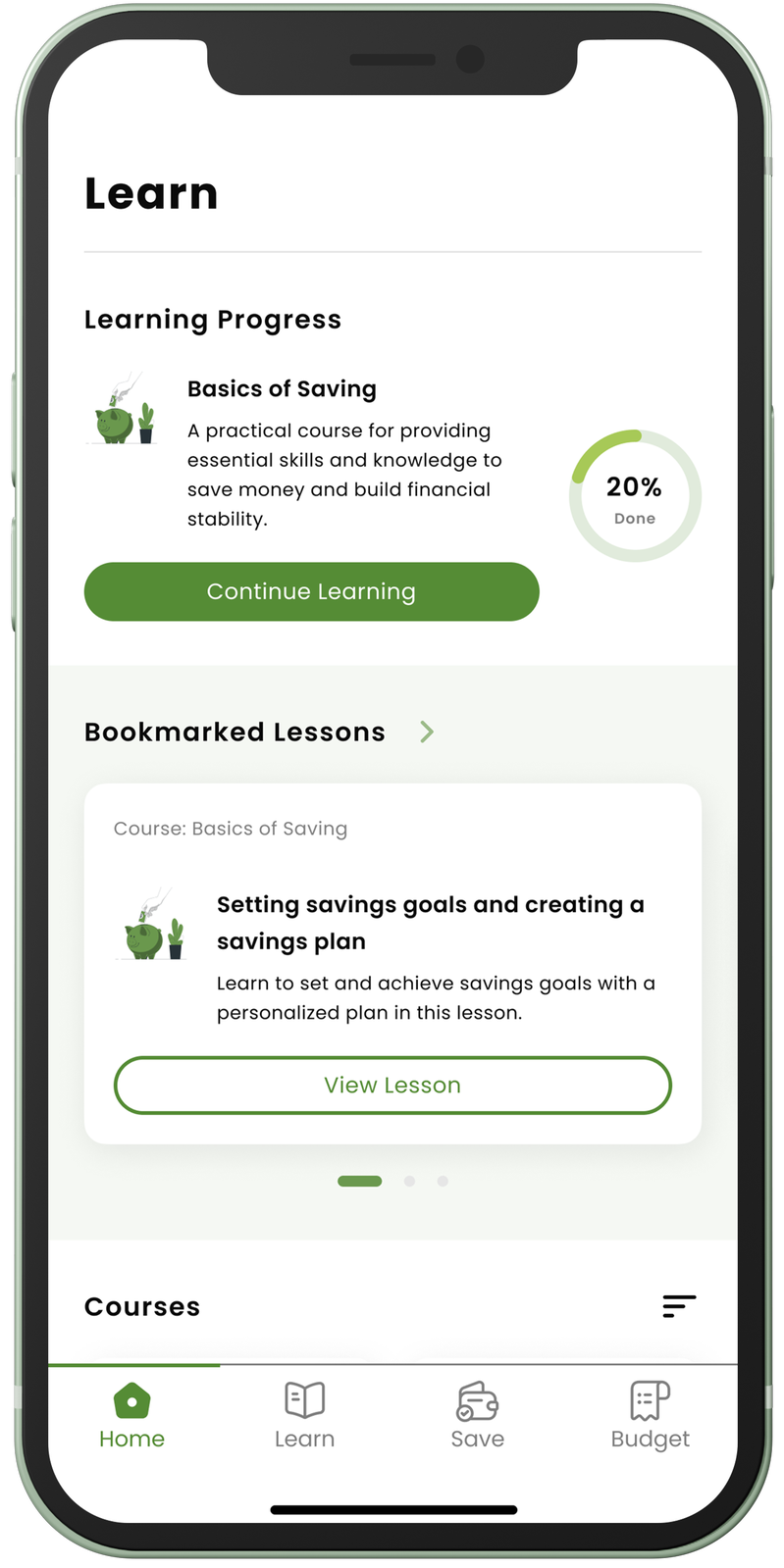

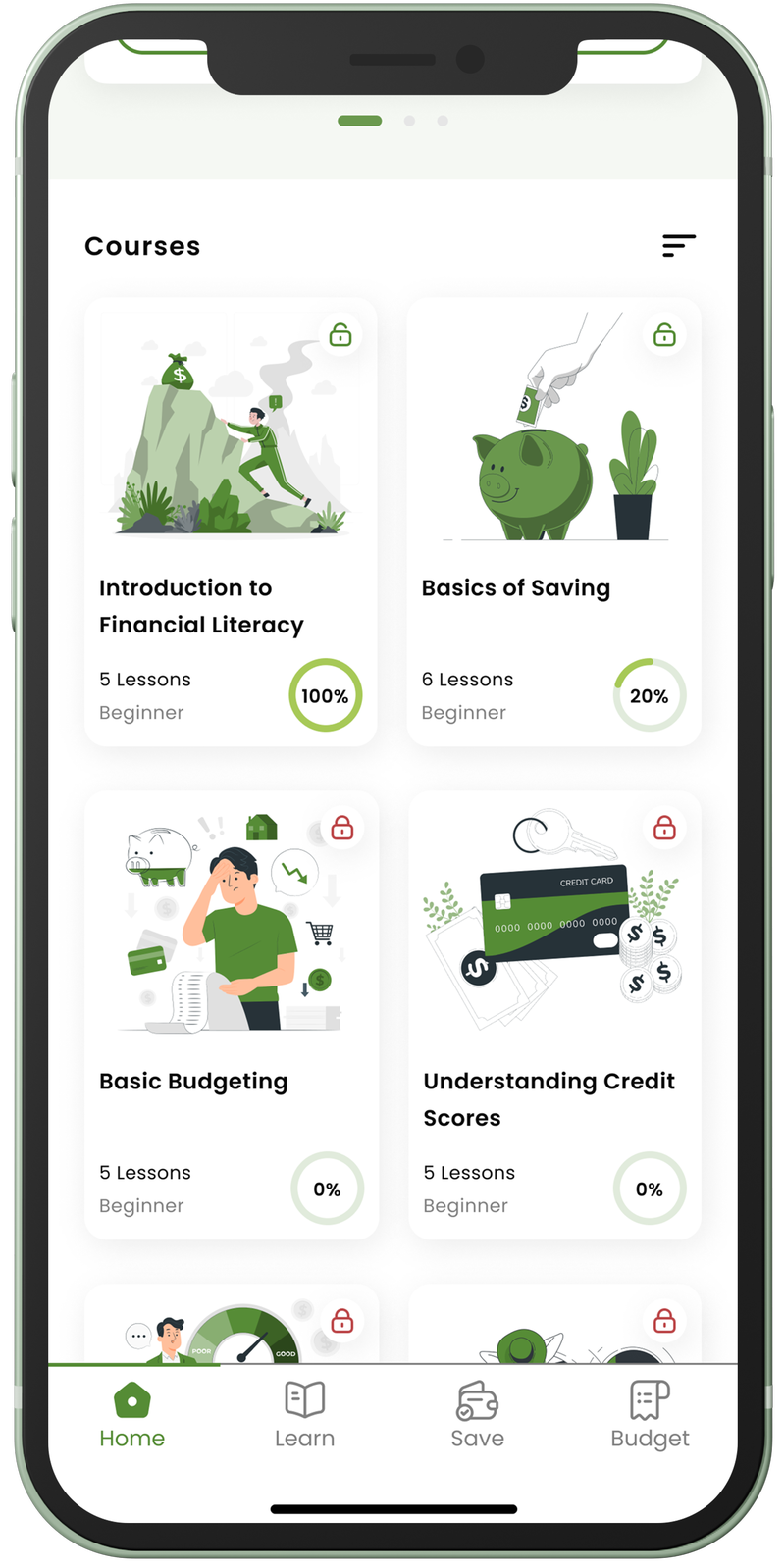

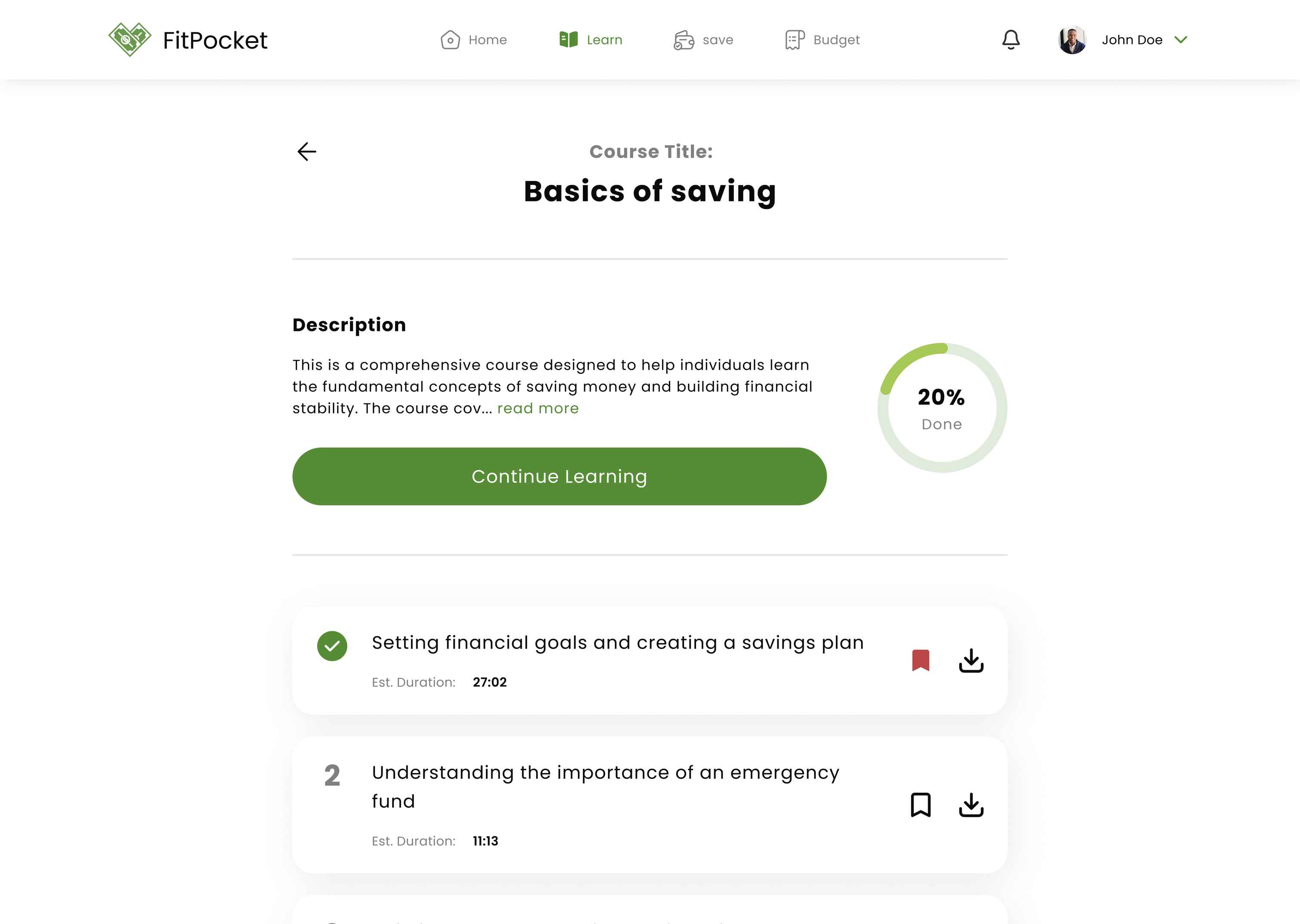

FitPocket is an educational platform designed to empower users to improve their financial literacy, make informed financial decisions, and ultimately achieve financial independence.

Financial literacy is often not included in the education systems worldwide, leaving many young adults without the necessary knowledge and skills to make informed financial decisions, leading to financial difficulties.

Design a cross-platform app that will provide accessible and interactive tools to educate users on key financial concepts and help them improve their financial literacy.

I conducted a survey of 30 participants to gather information about their needs, current financial literacy knowledge and their learning preferences.

I interviewed 5 participants representative of the target demography to gather in-depth information about their learning experiences and challenges with financial literacy.

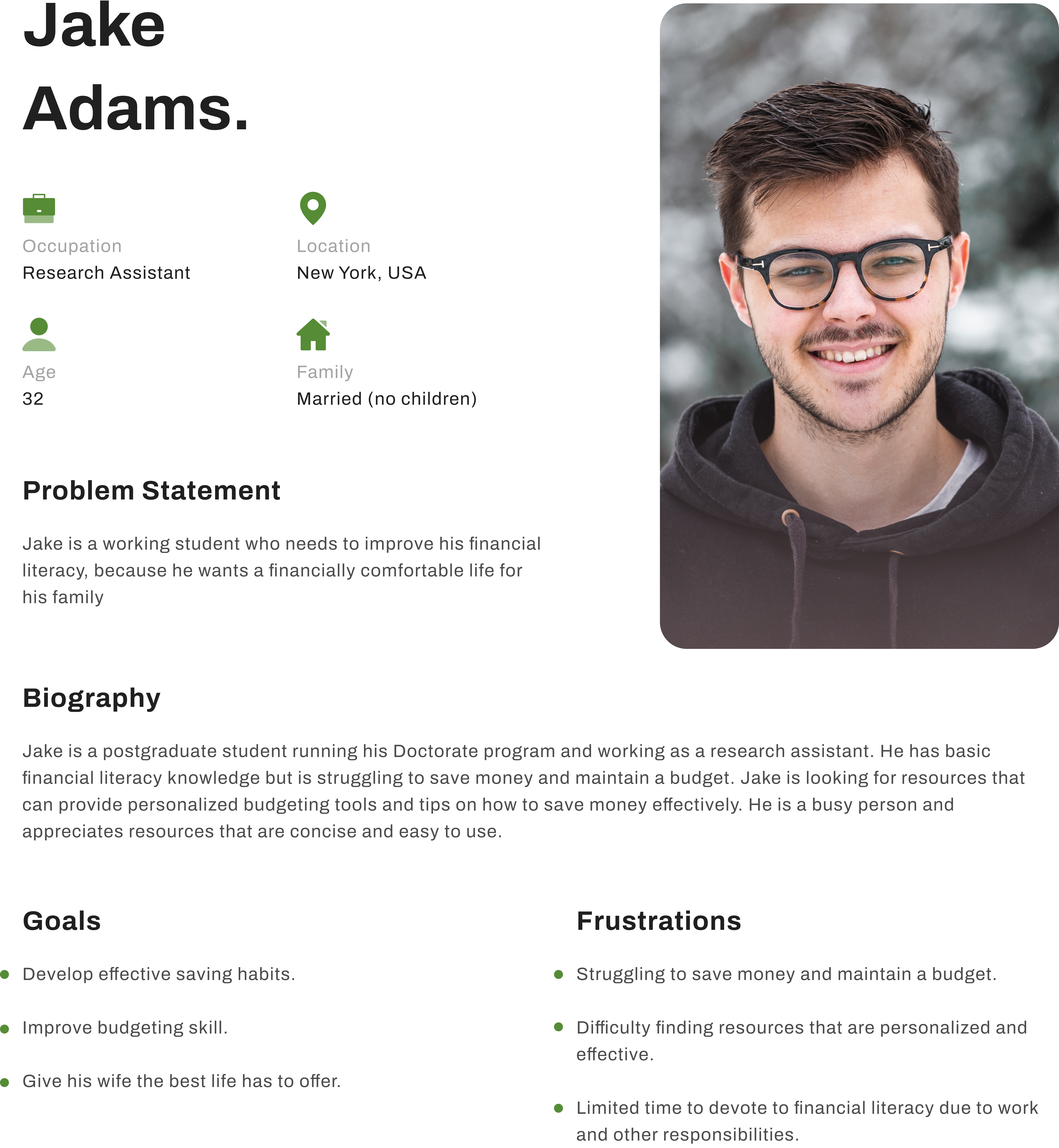

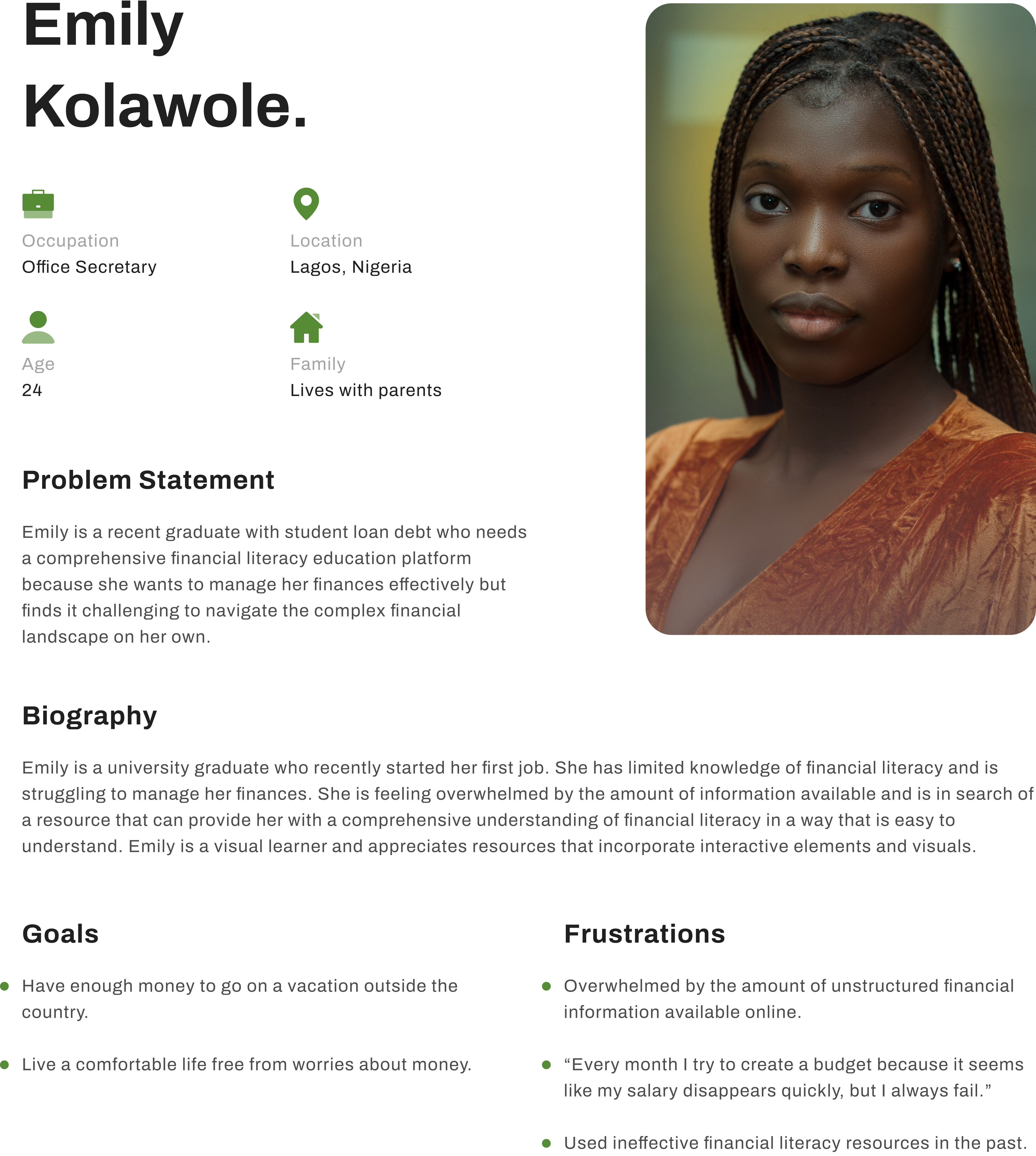

Based on the information gathered from the research exercises, I created 2 user personas that are representative of the target demography.

The insights we gathered can be summarized into three main pain points.

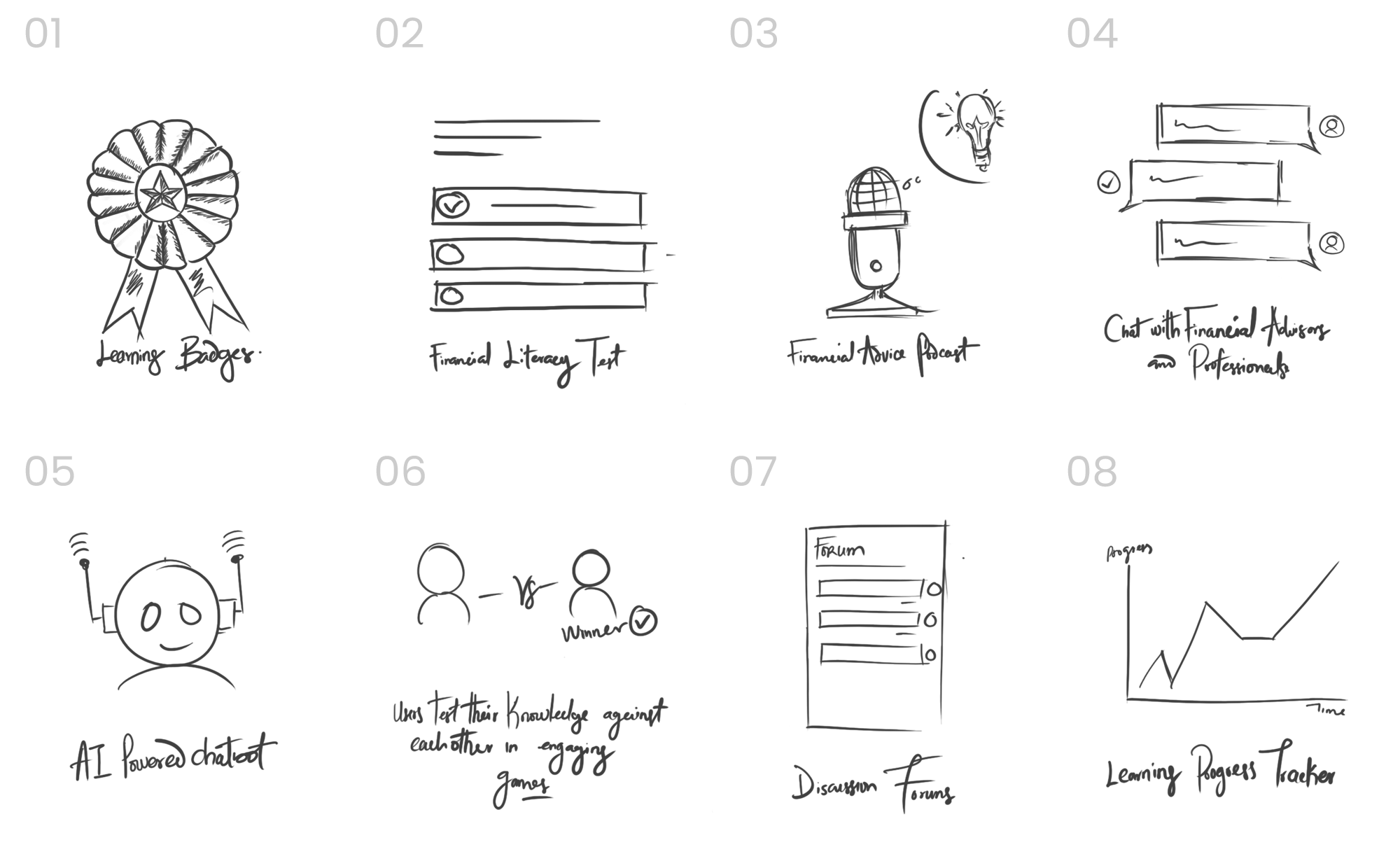

To address user pain points, I brainstormed multiple solutions using the "crazy-eights" exercise, sketching out eight concepts in eight minutes to identify and select the most effective ideas.

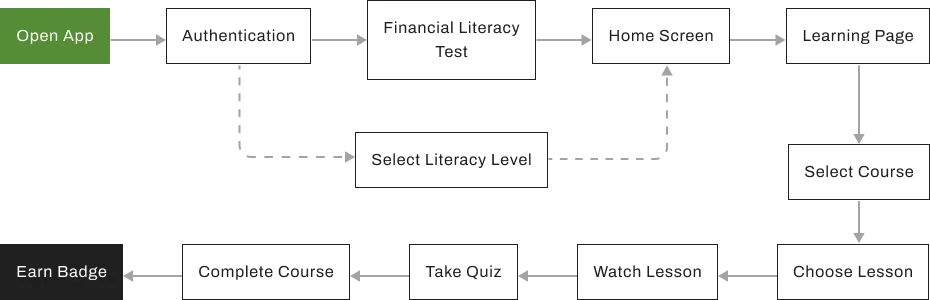

I made three diagrams to understand how users interact with the application. These helped me analyze and visualize the different steps involved in navigating it.

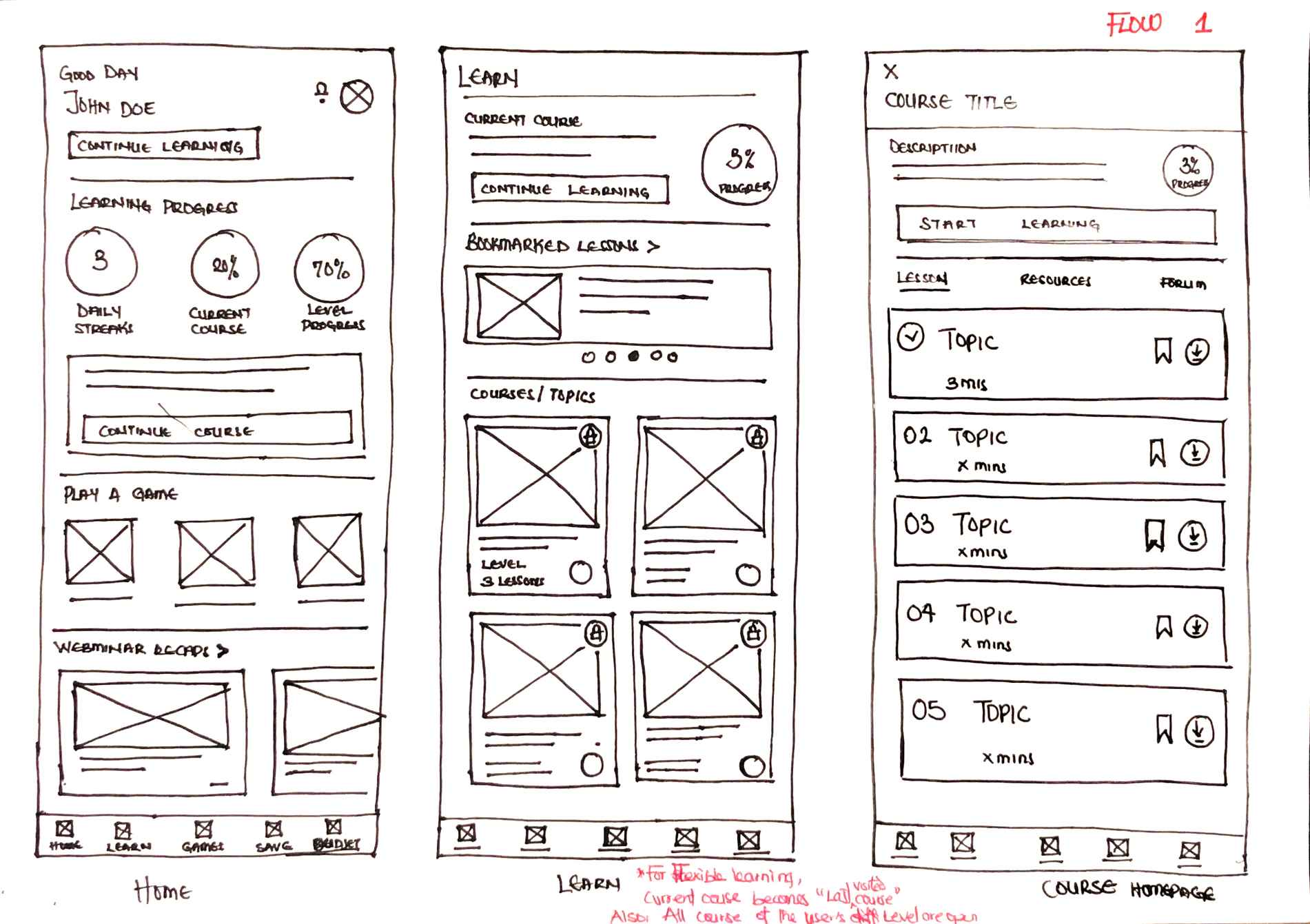

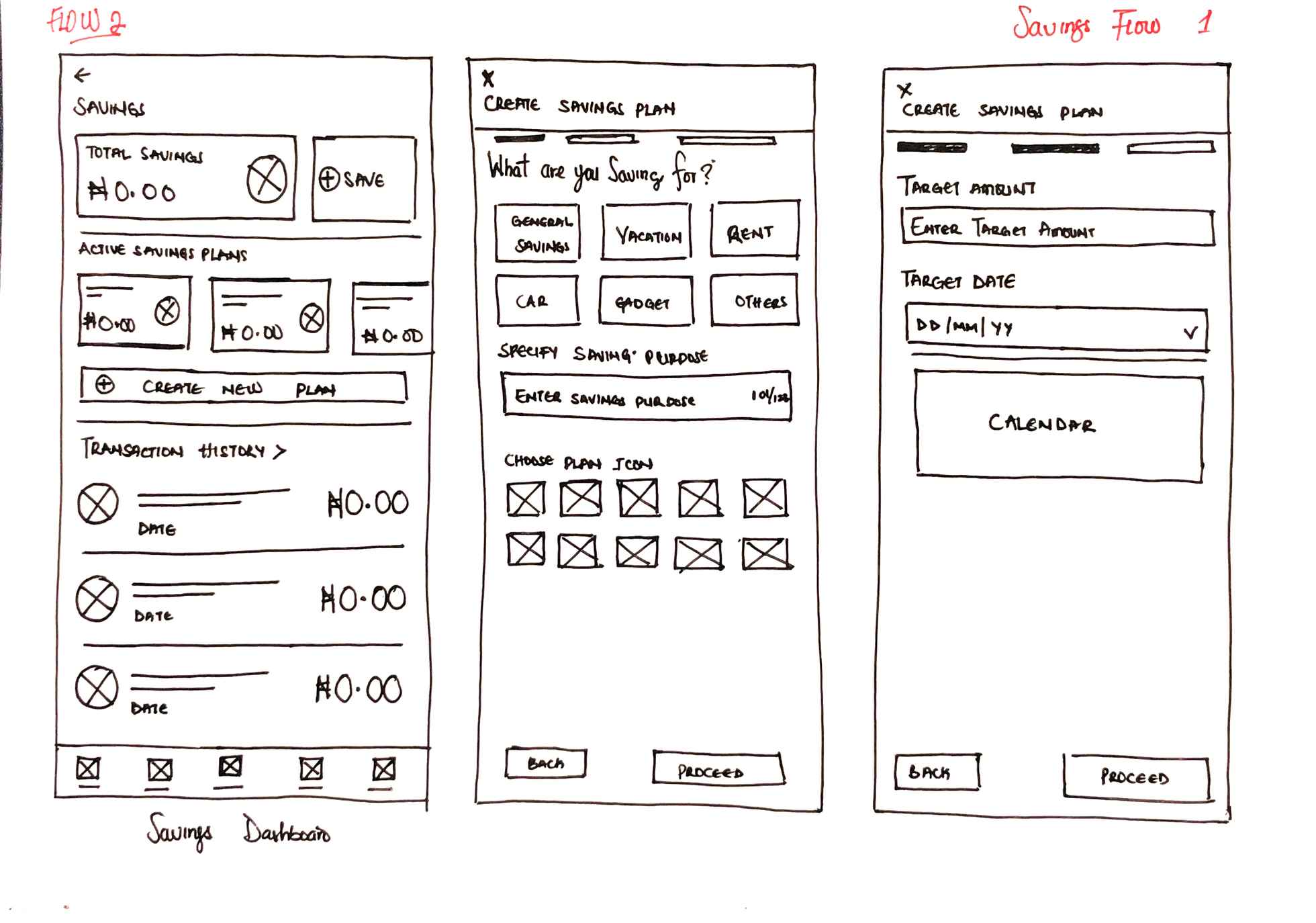

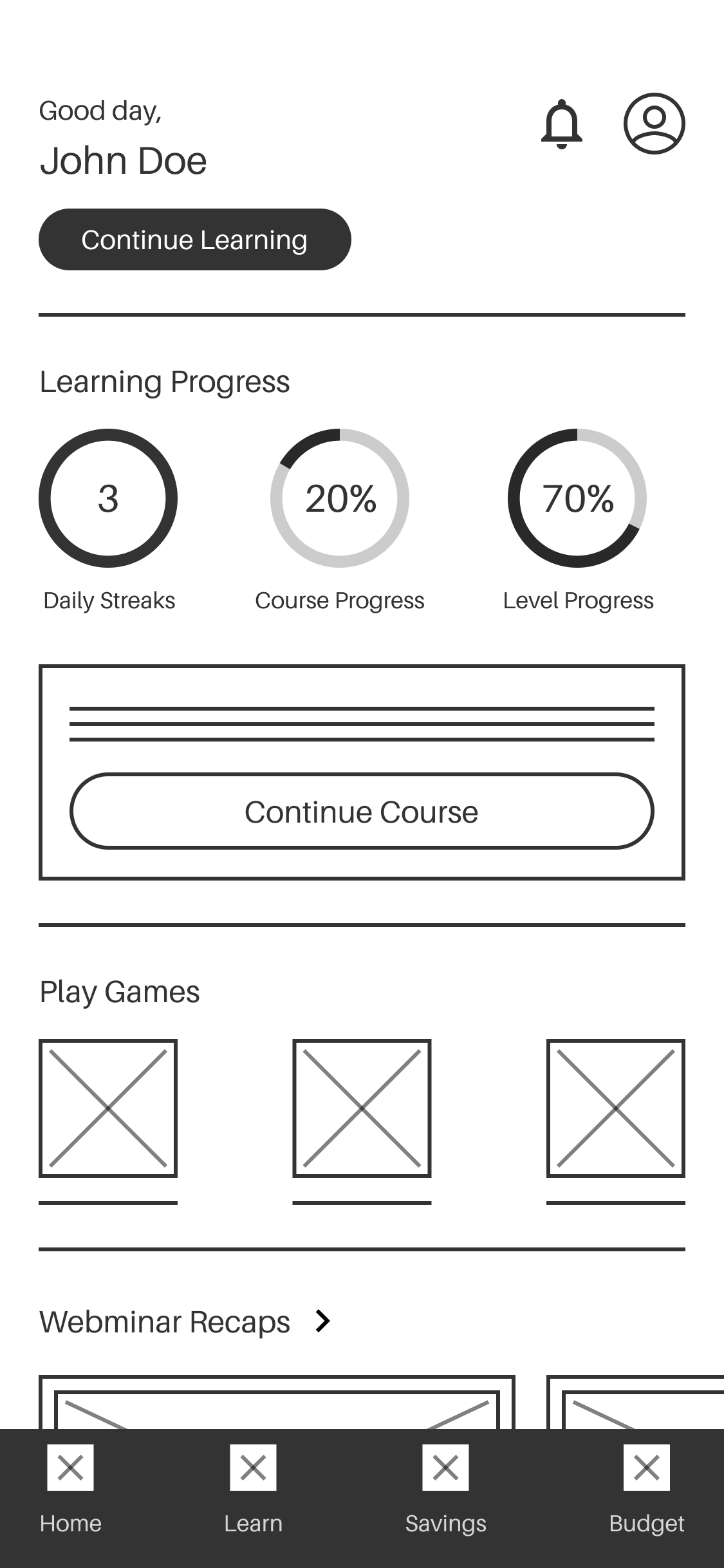

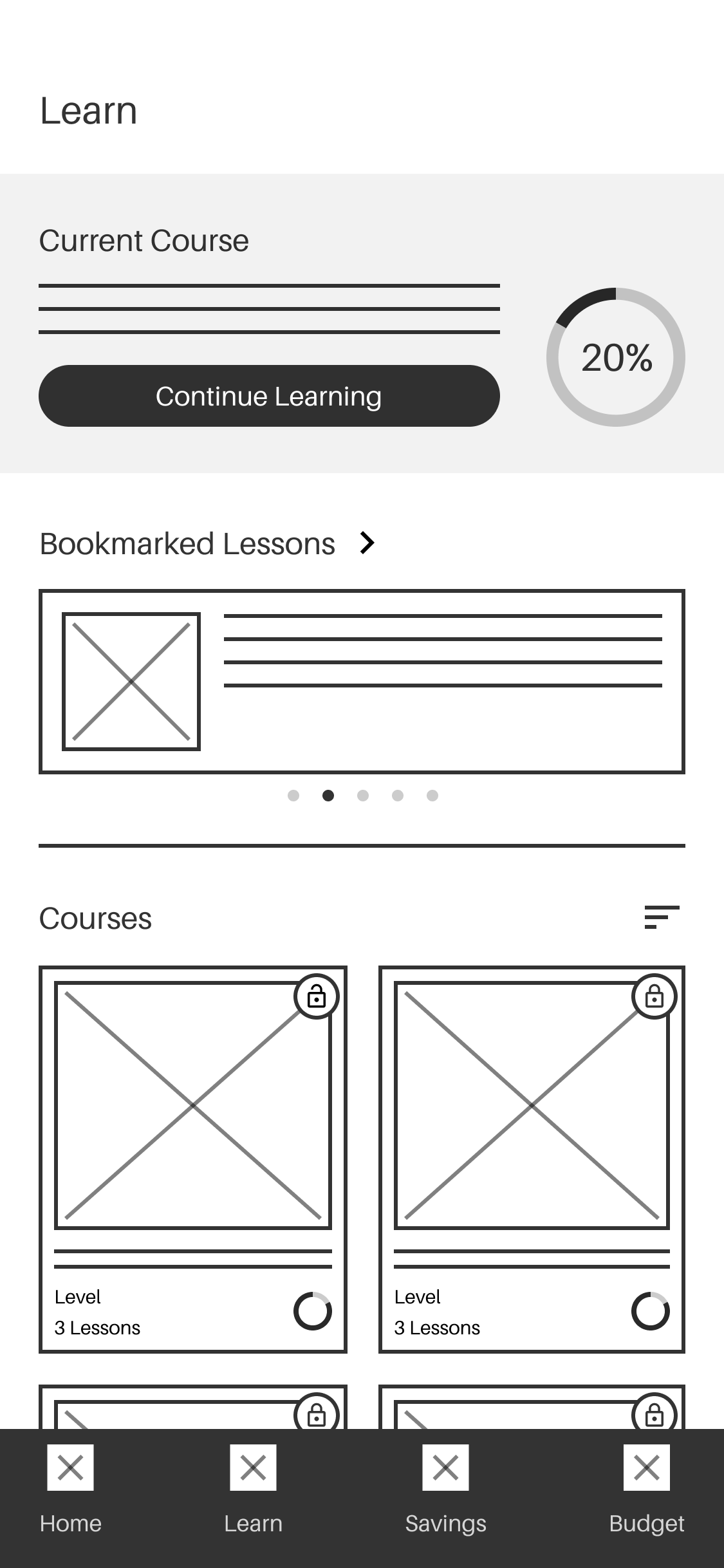

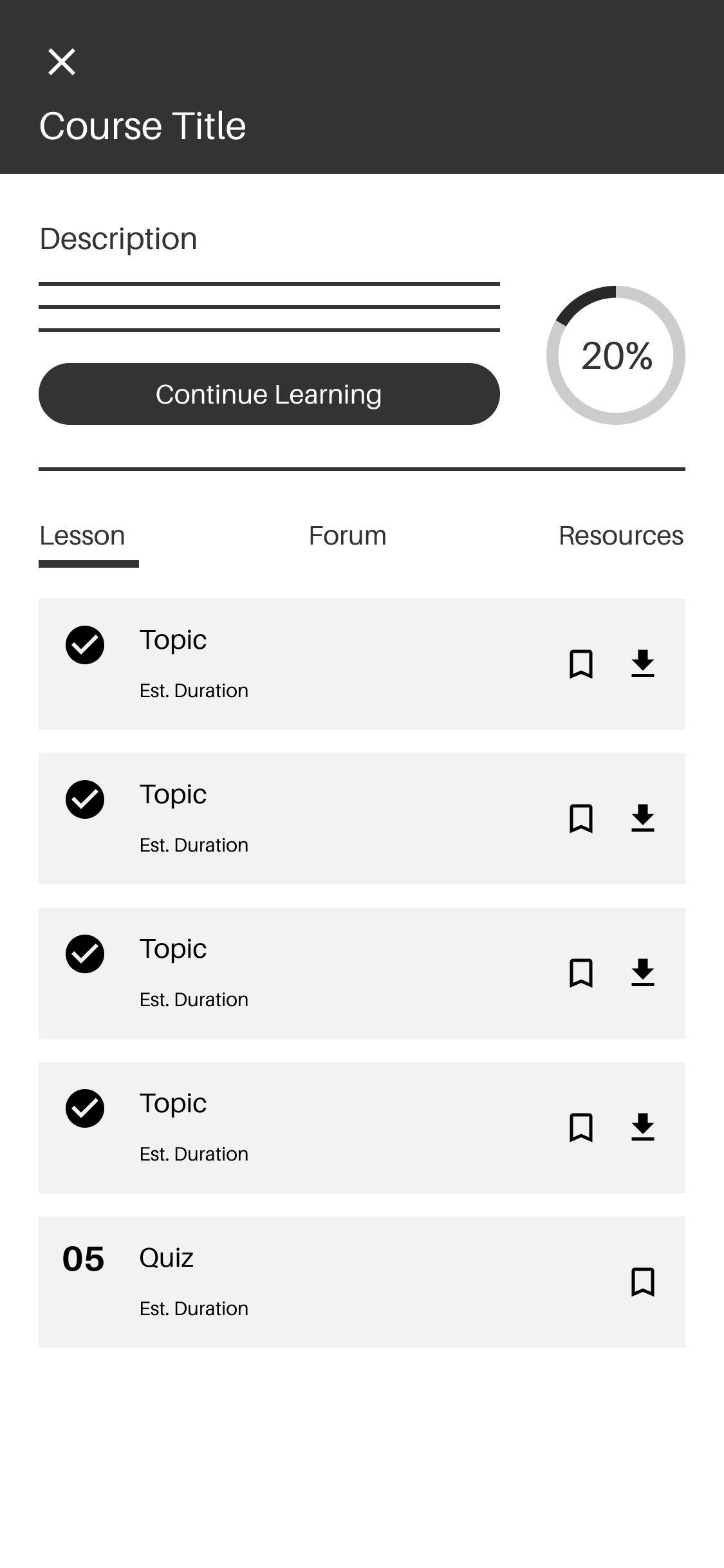

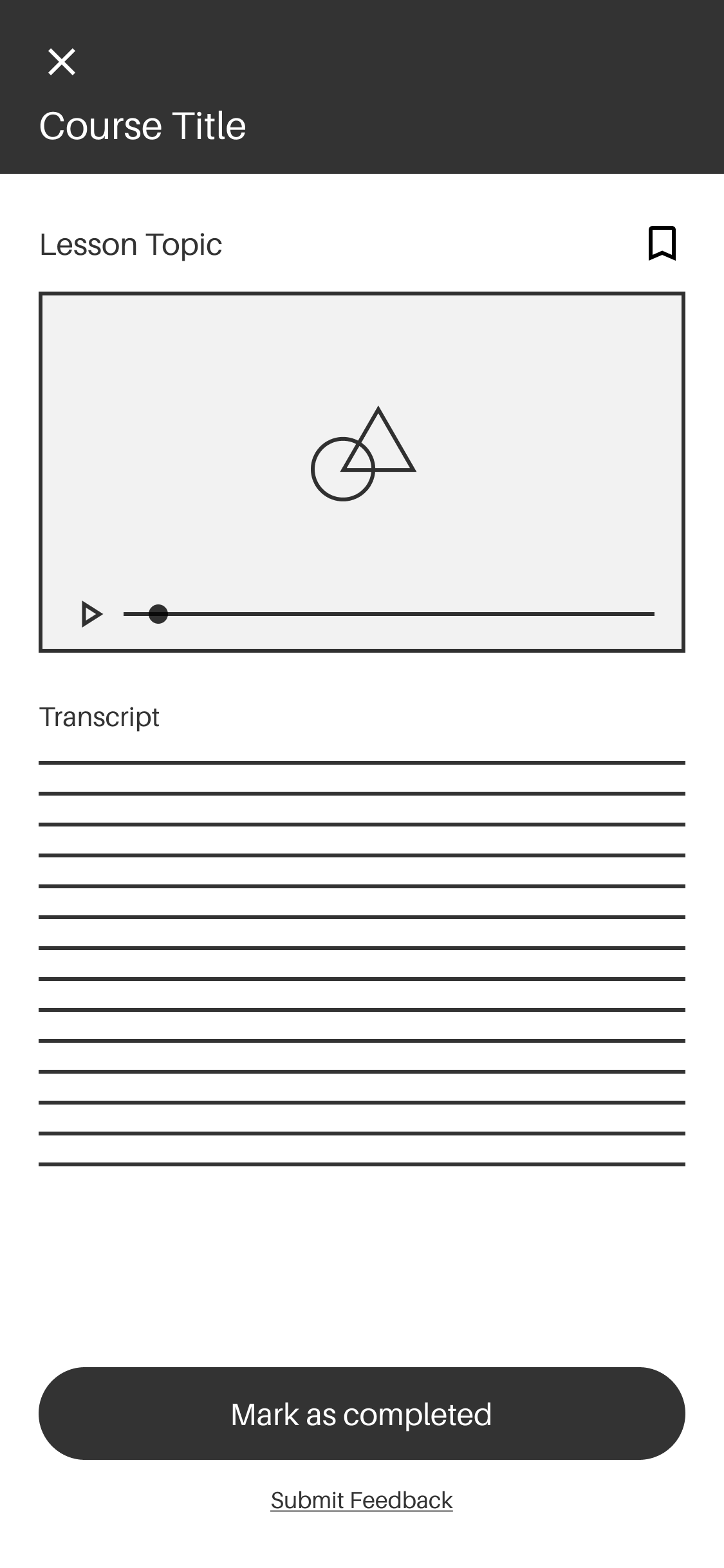

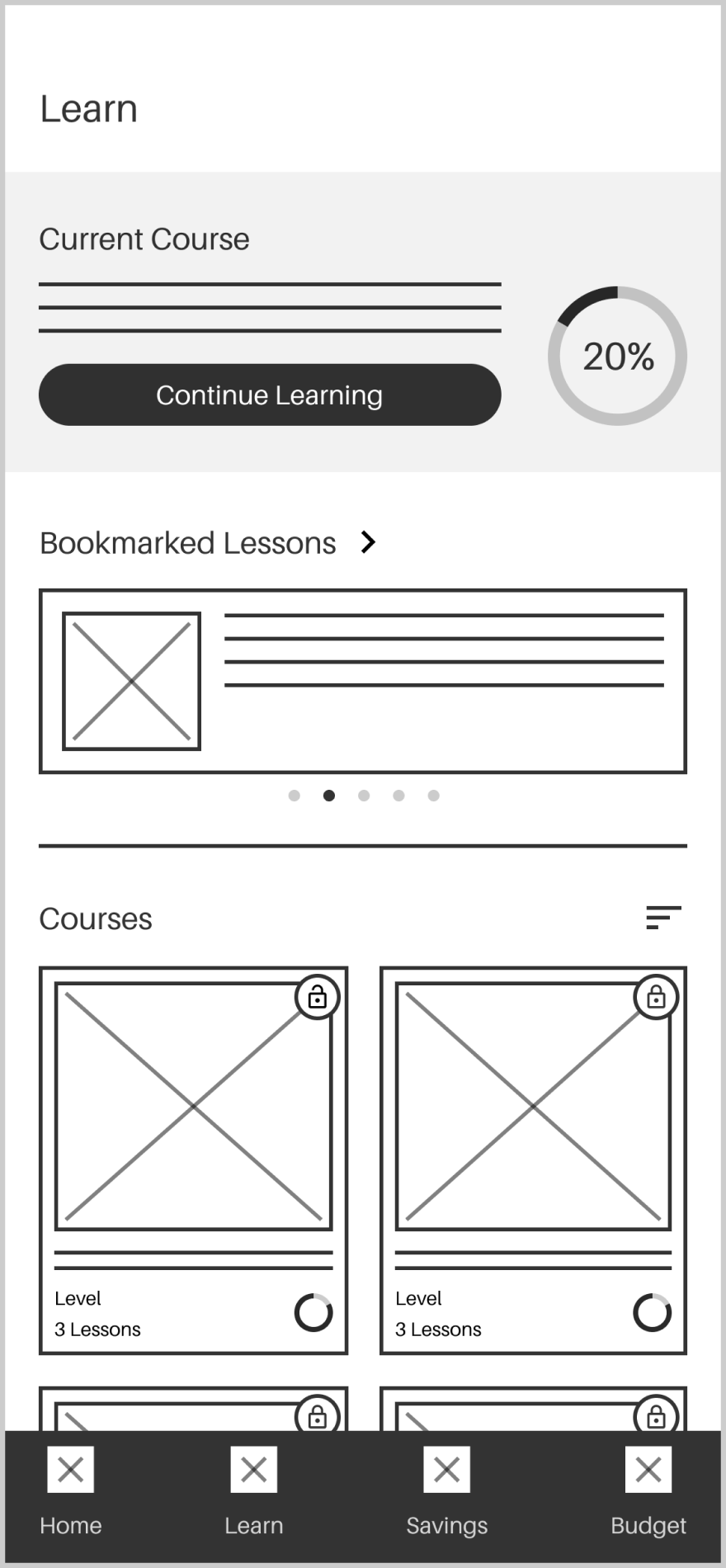

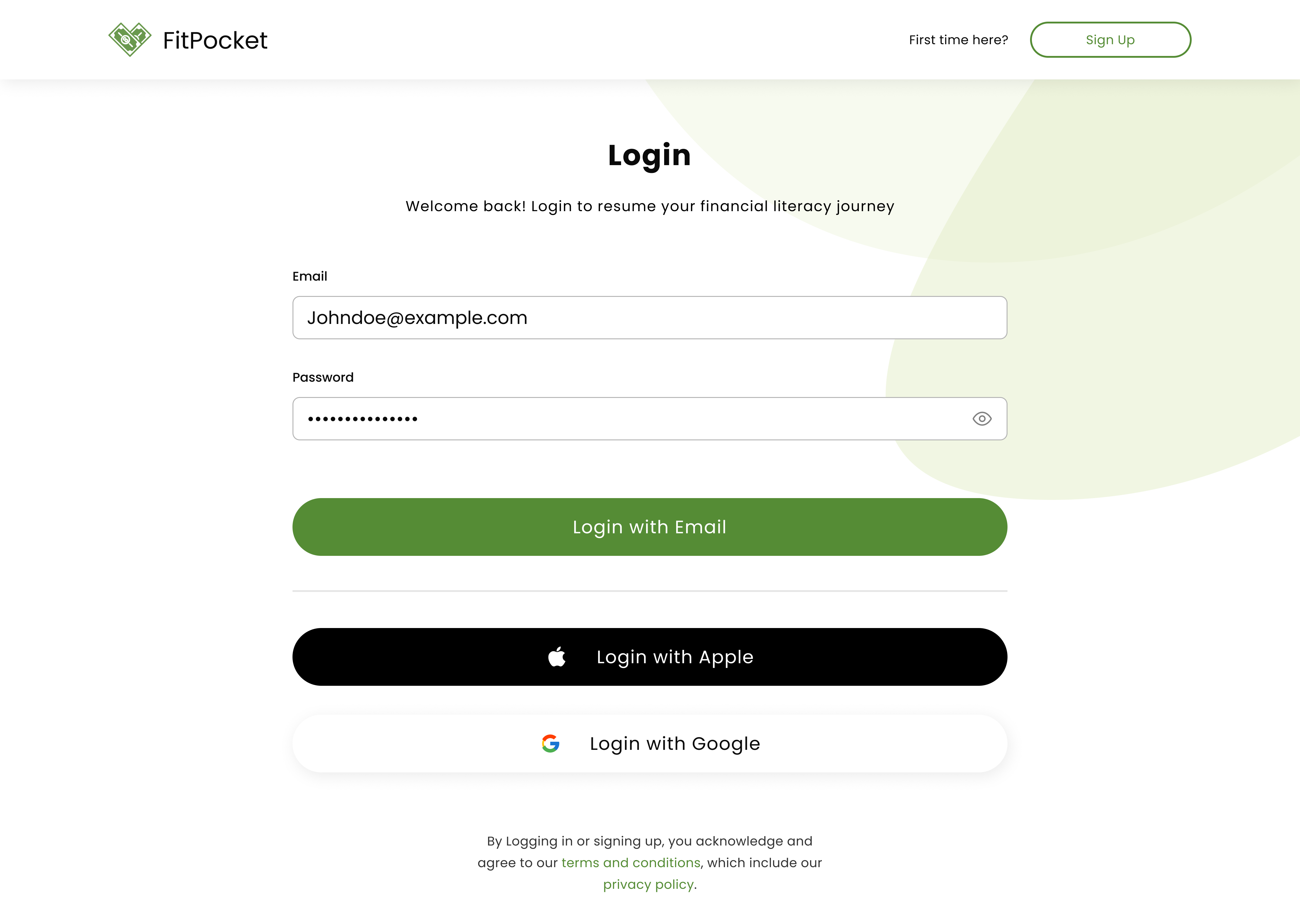

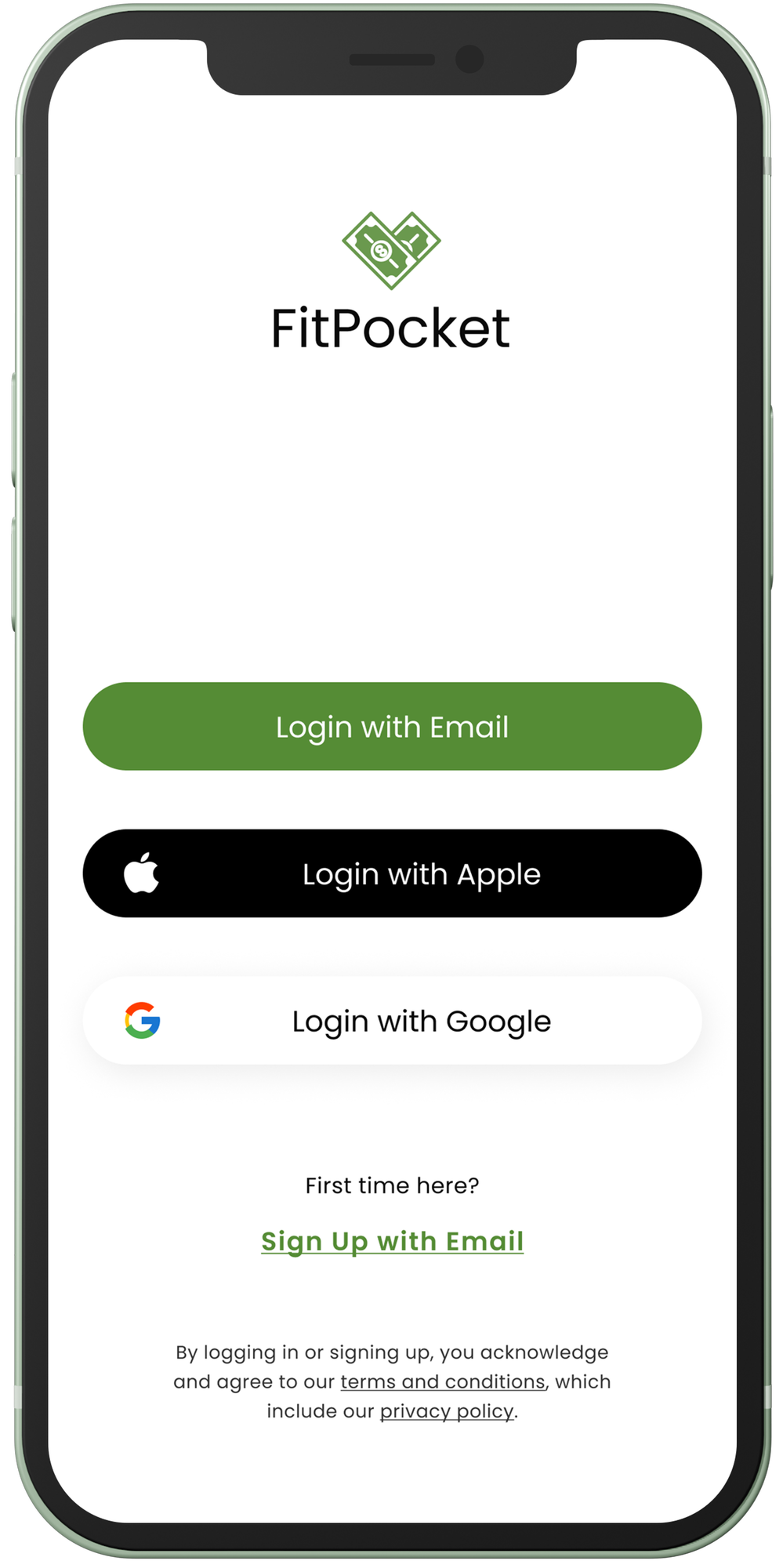

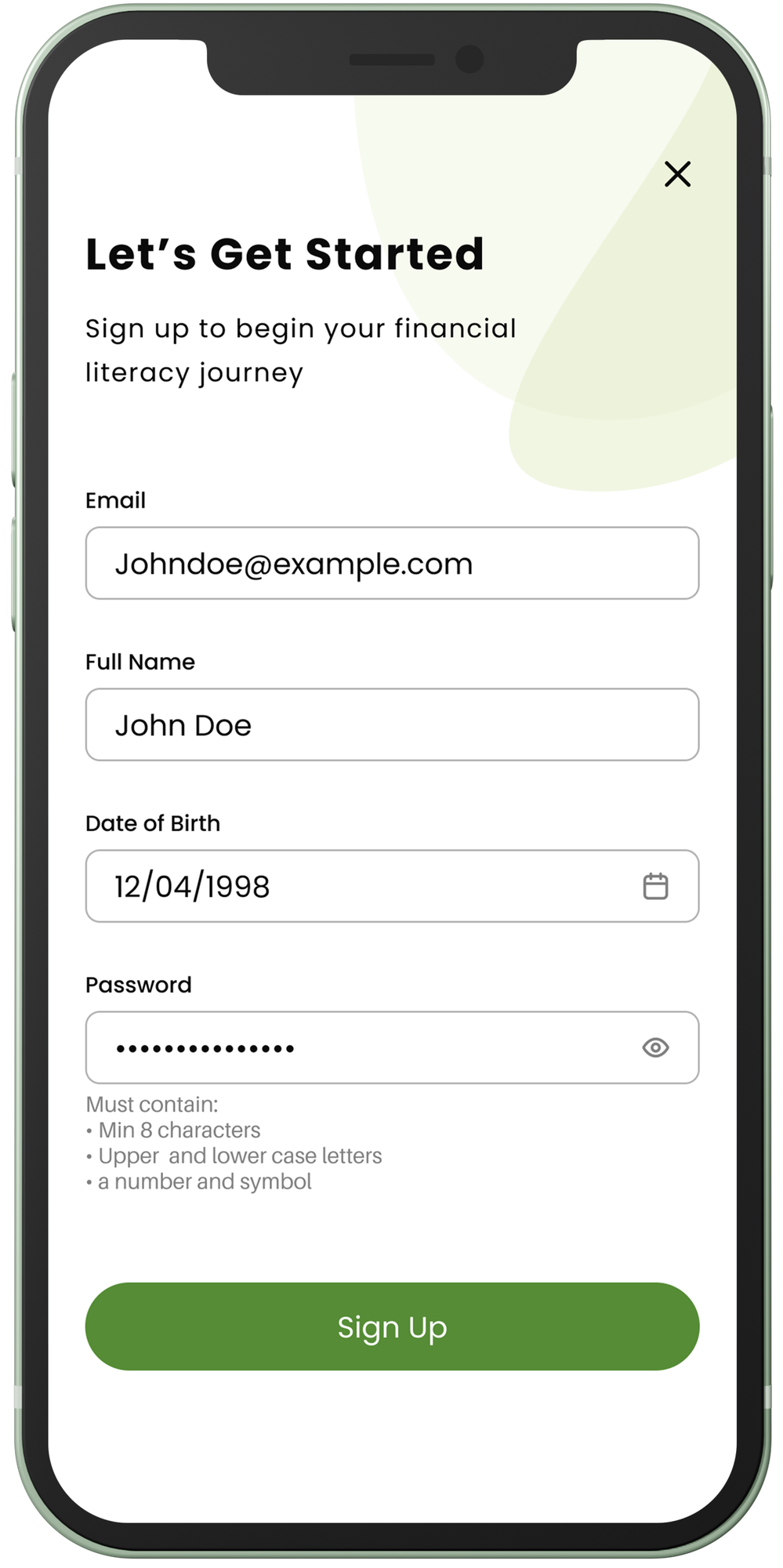

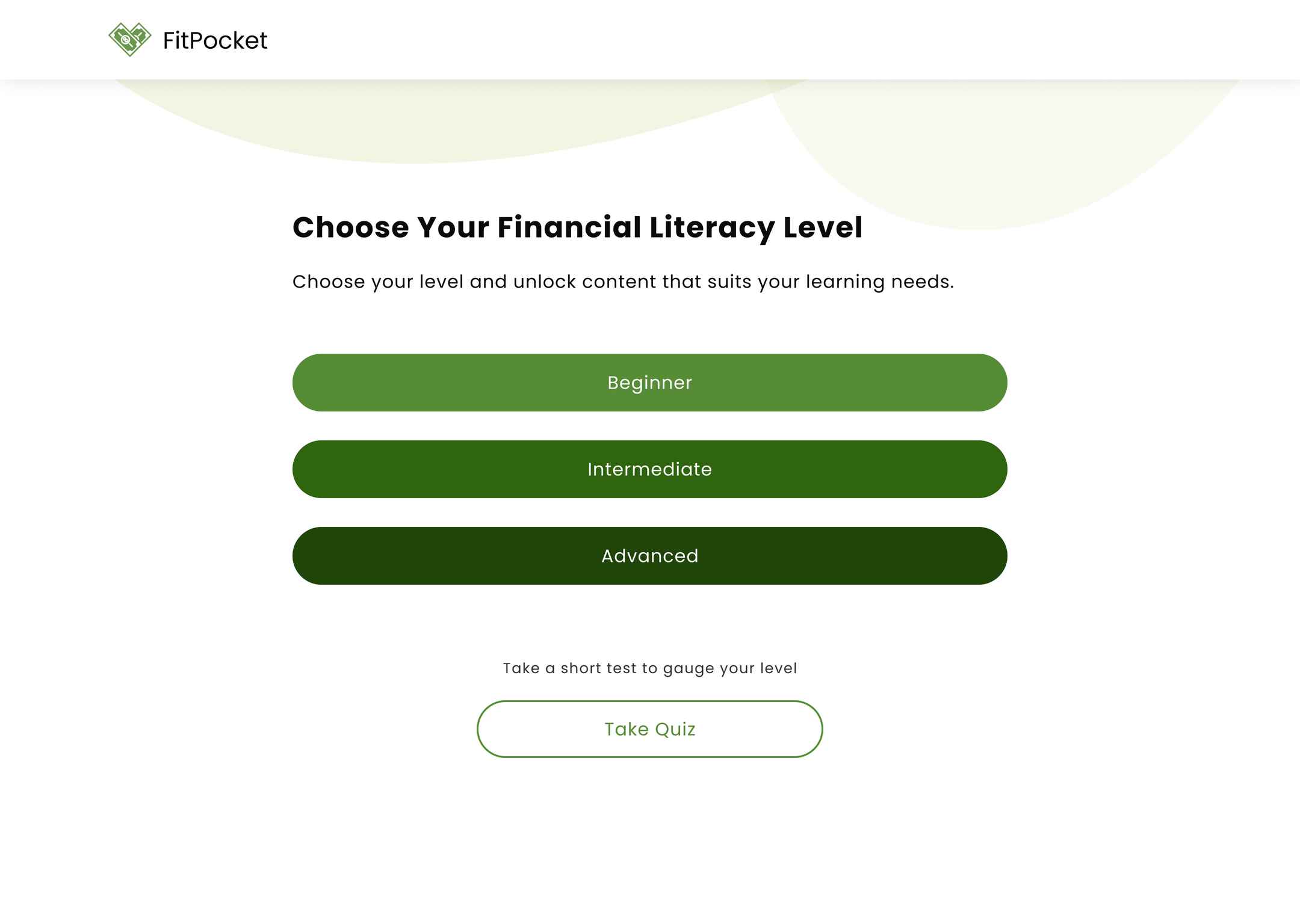

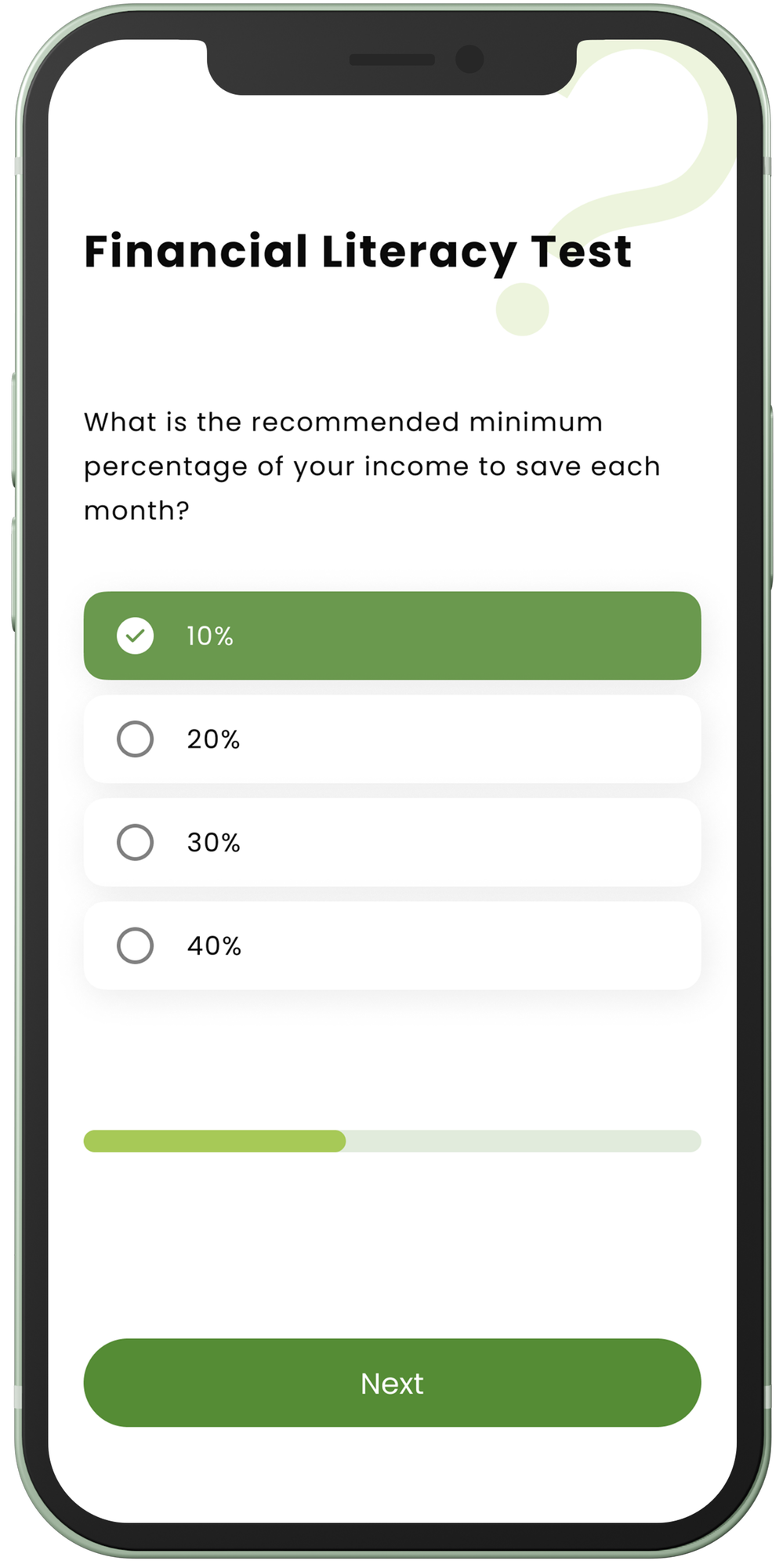

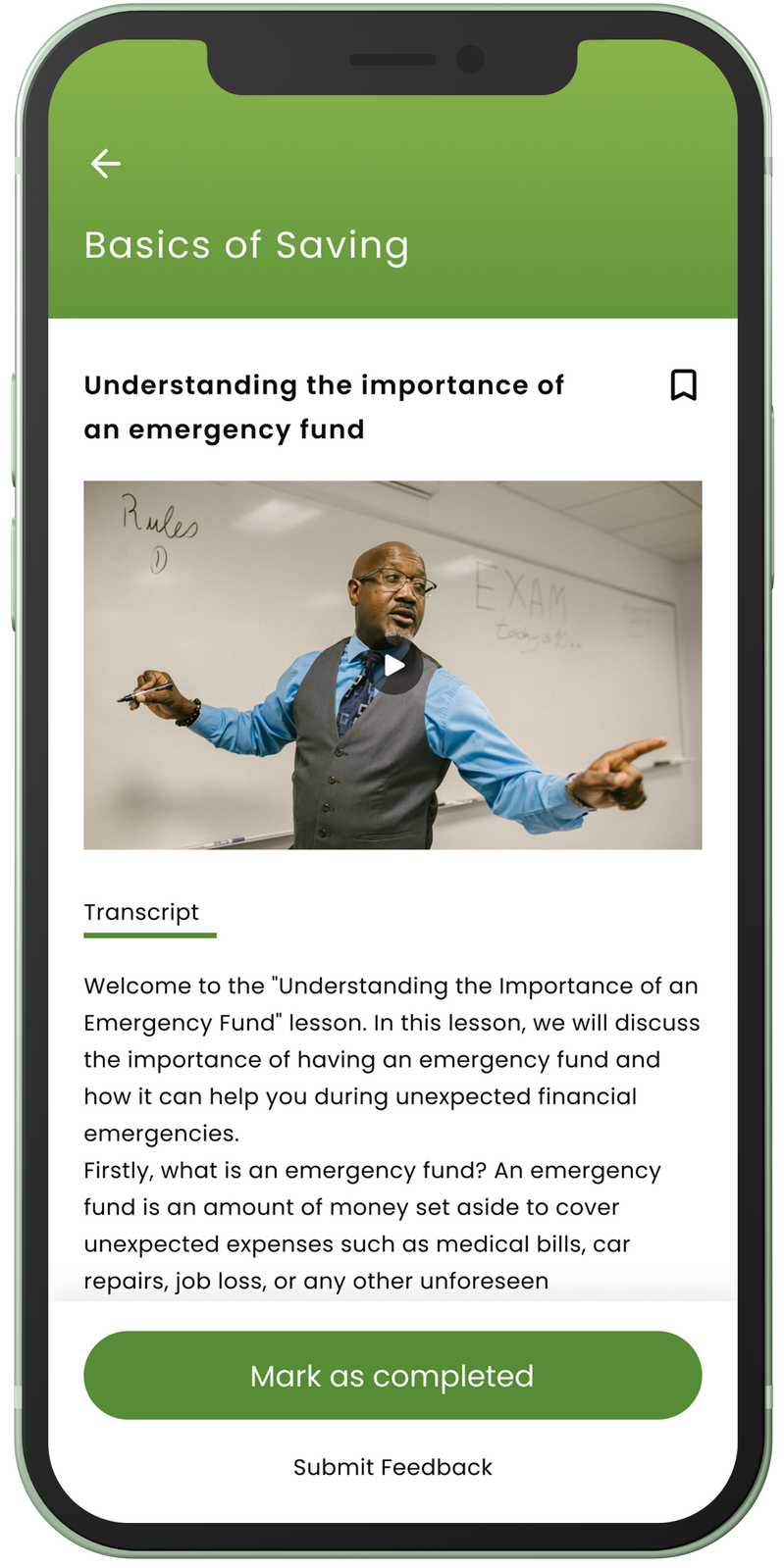

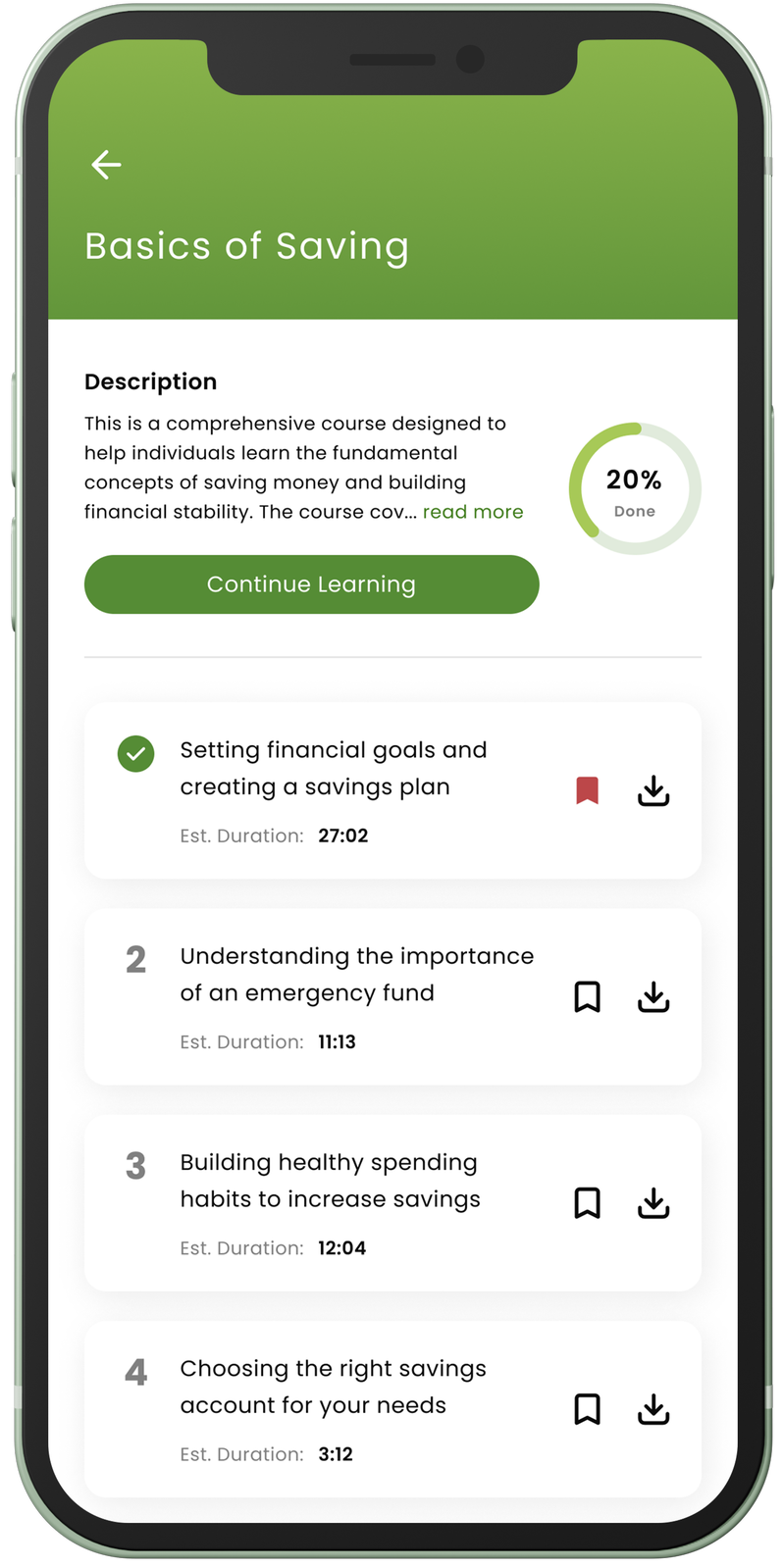

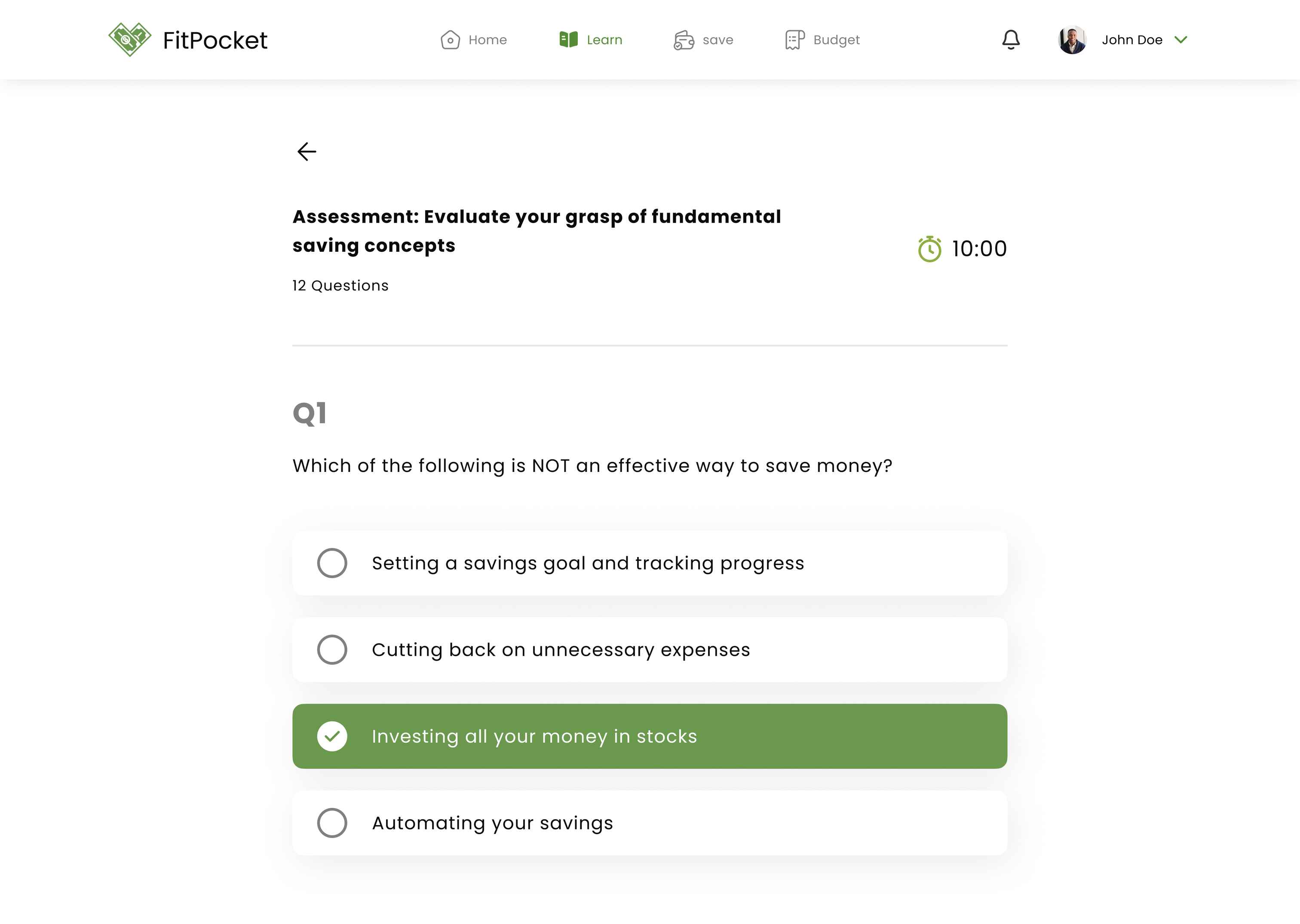

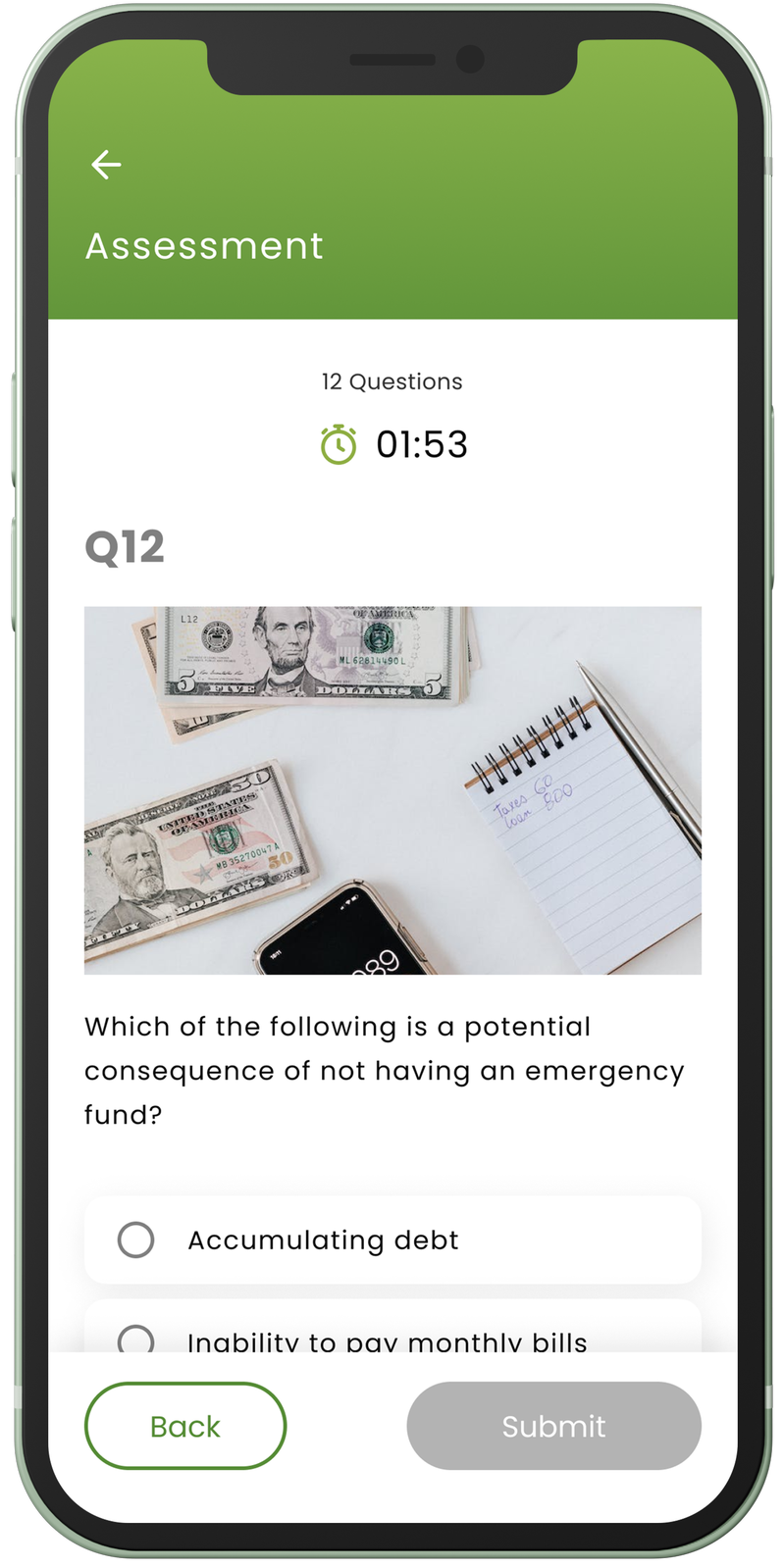

I created paper wireframes, digitized them to show user flows, and built a low-fidelity prototype for testing before proceeding with high-fidelity mockups.

I performed a round of usability studies using Maze testing platform to gather feedback on the wireframes and identify potential issues that might affect the user's ability to perform tasks on the app.

I categorized observations based on similarities to identify patterns and themes, uncovering underlying causes and gaining deeper insights that may have otherwise gone unnoticed.

.jpg)

Users had difficulty understanding the functions of some buttons and they want clear button labels.

Before

.png)

After

People expected certain buttons to make their journey faster.

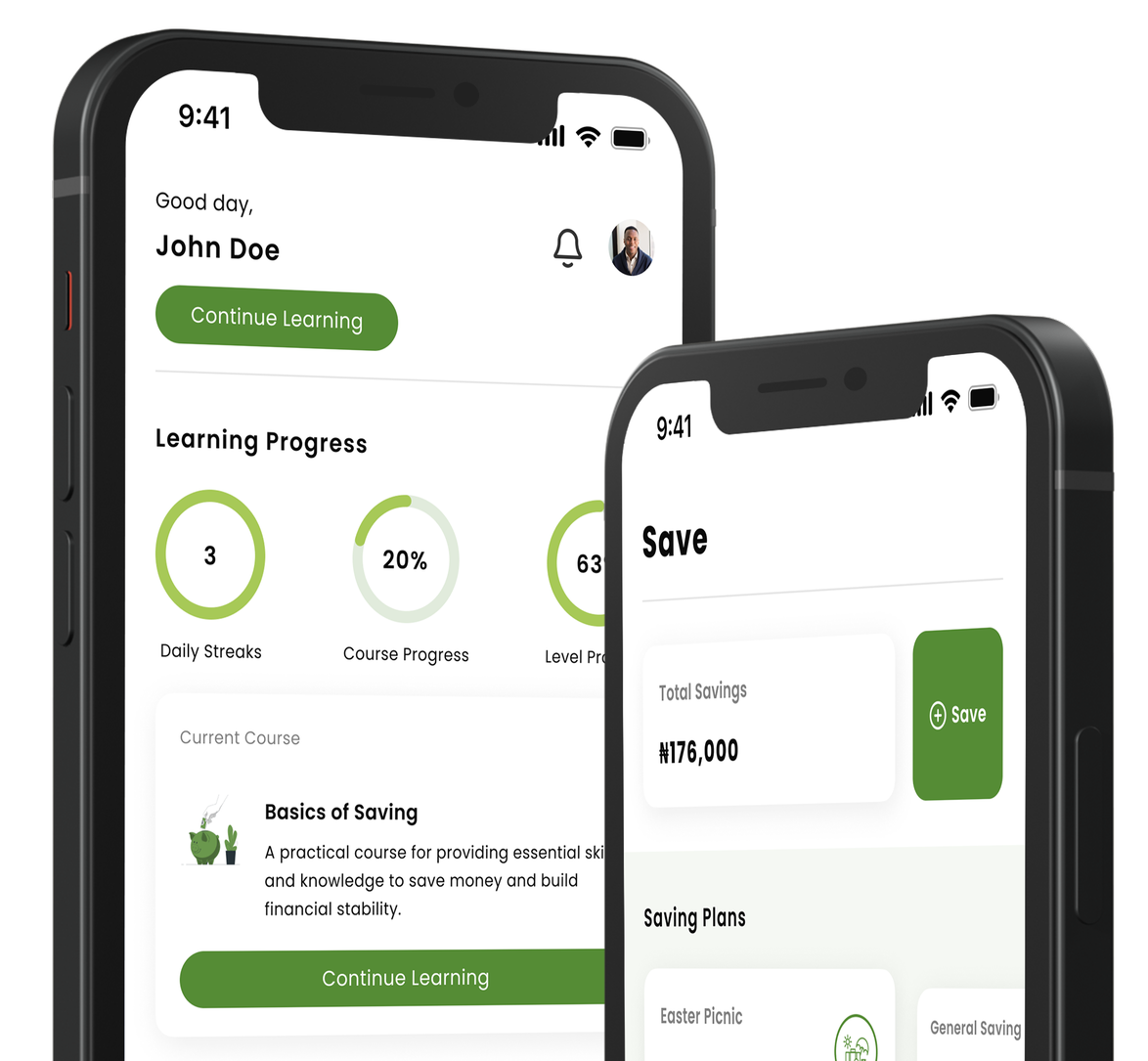

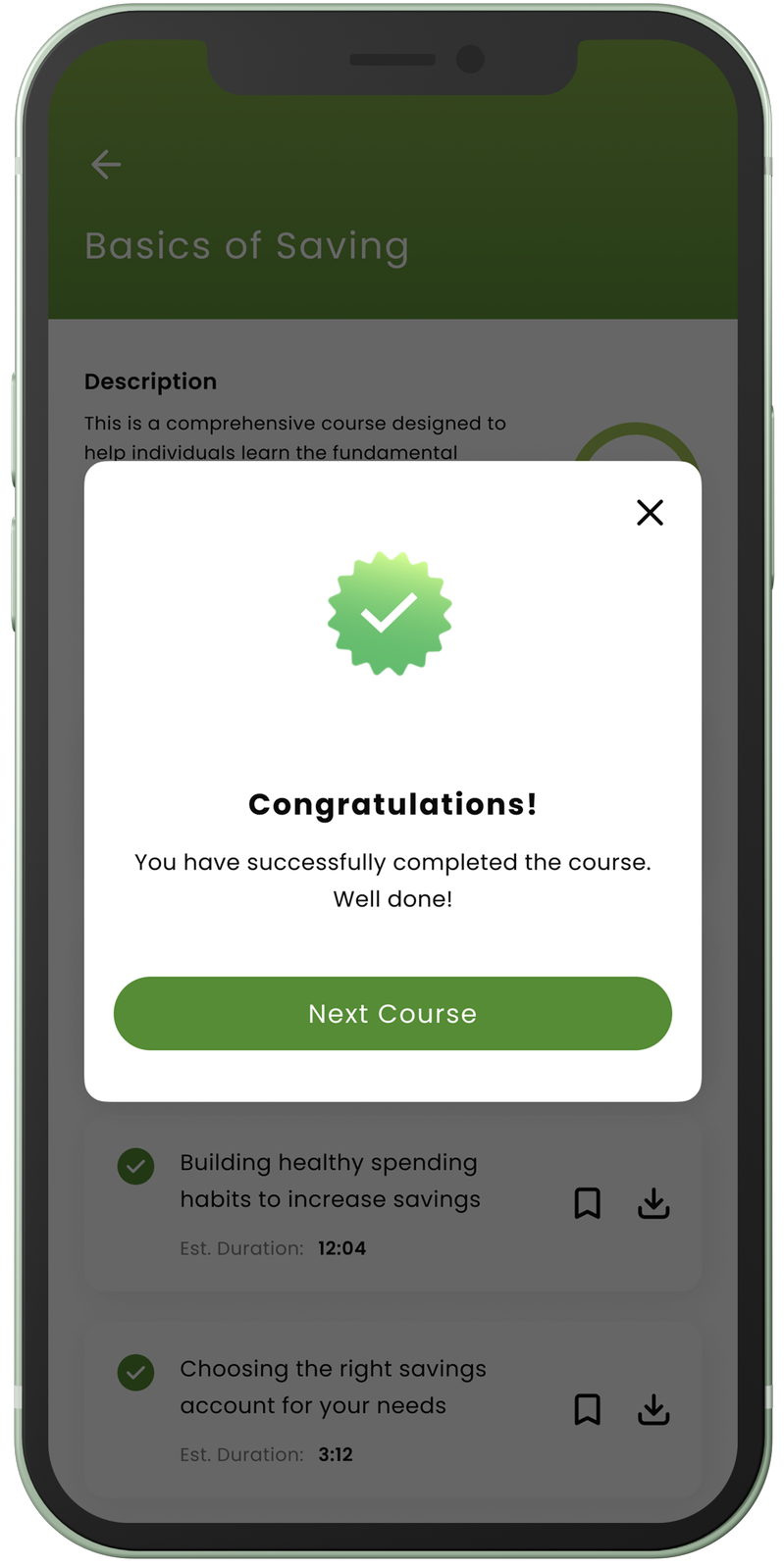

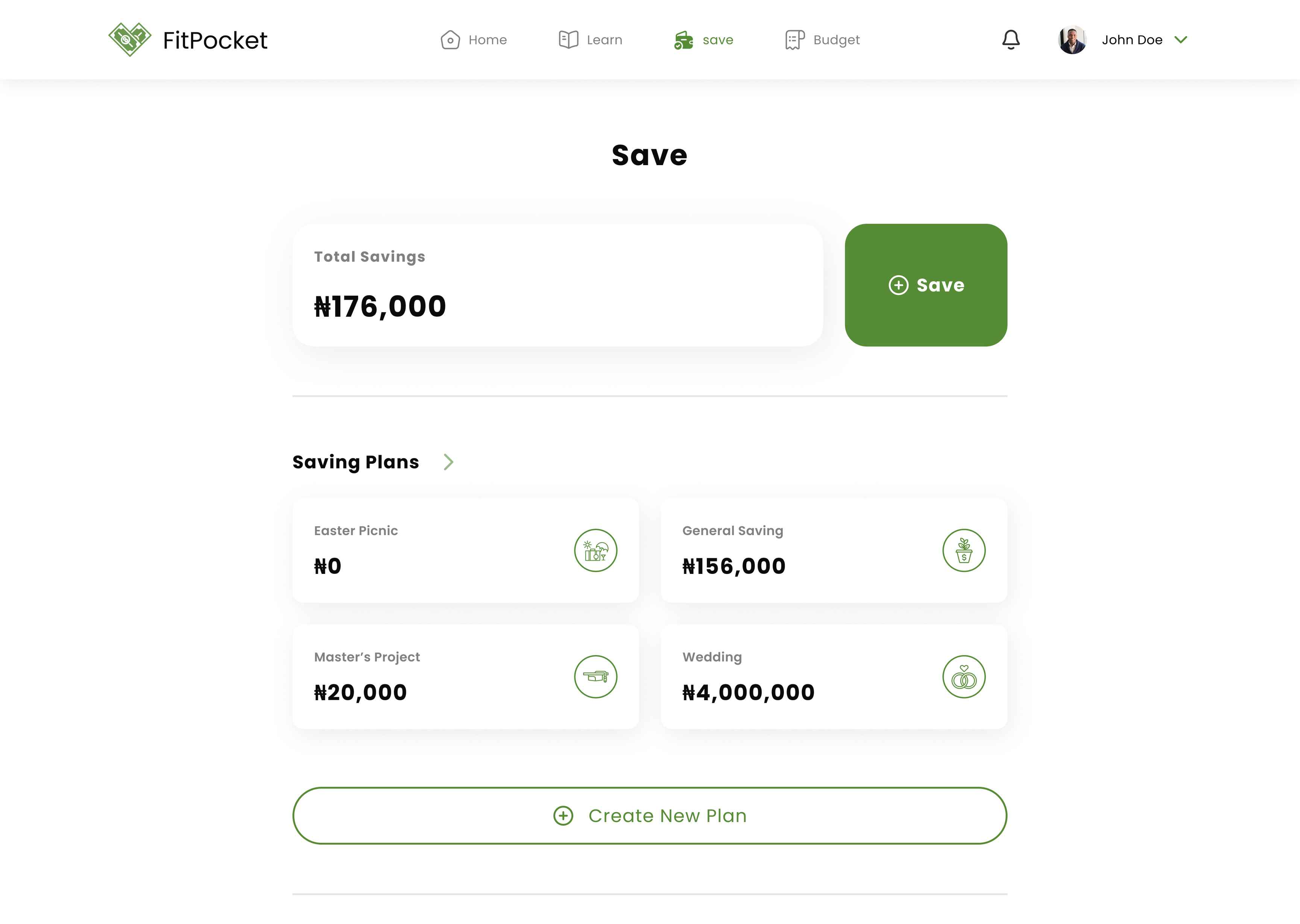

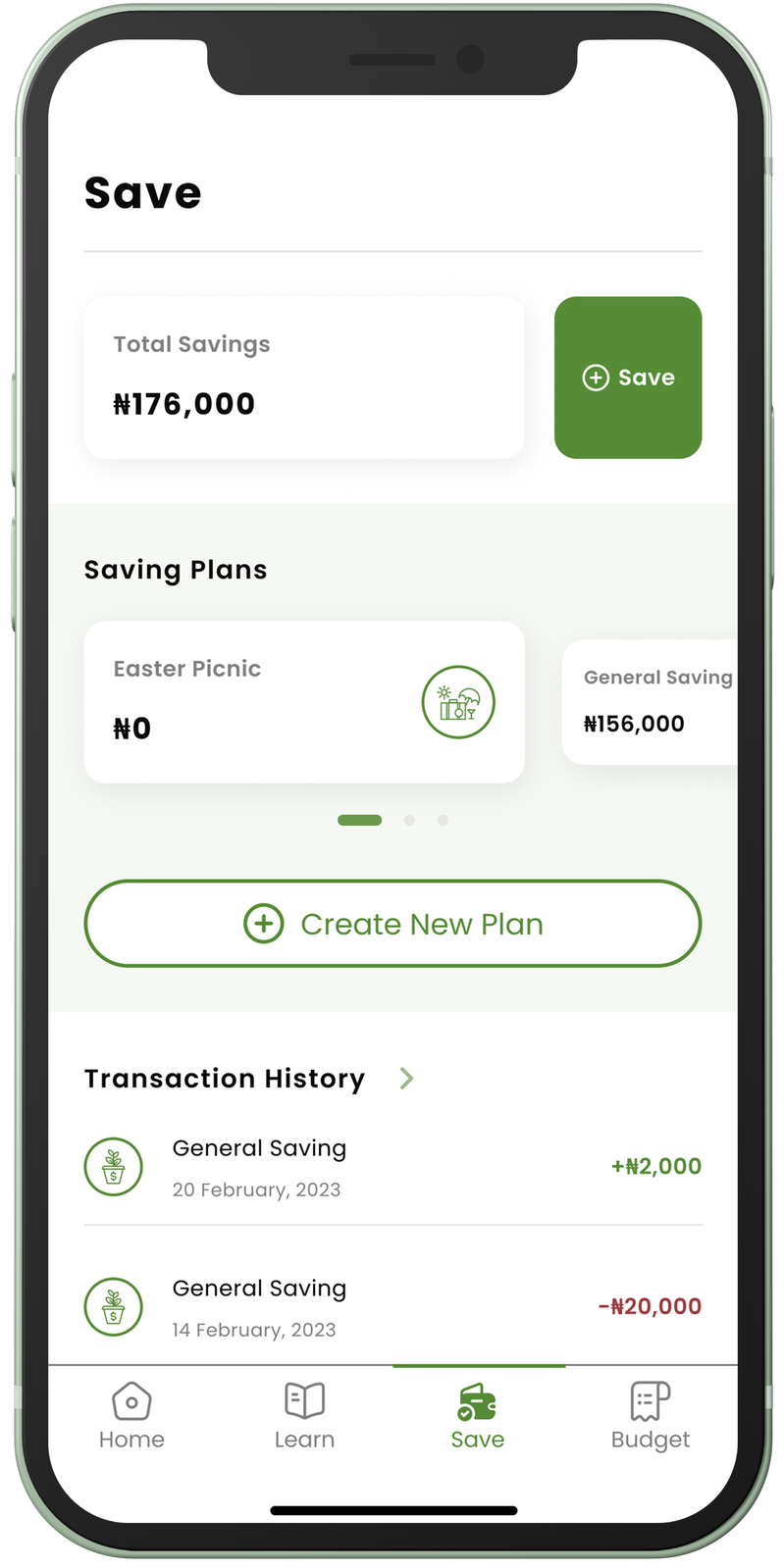

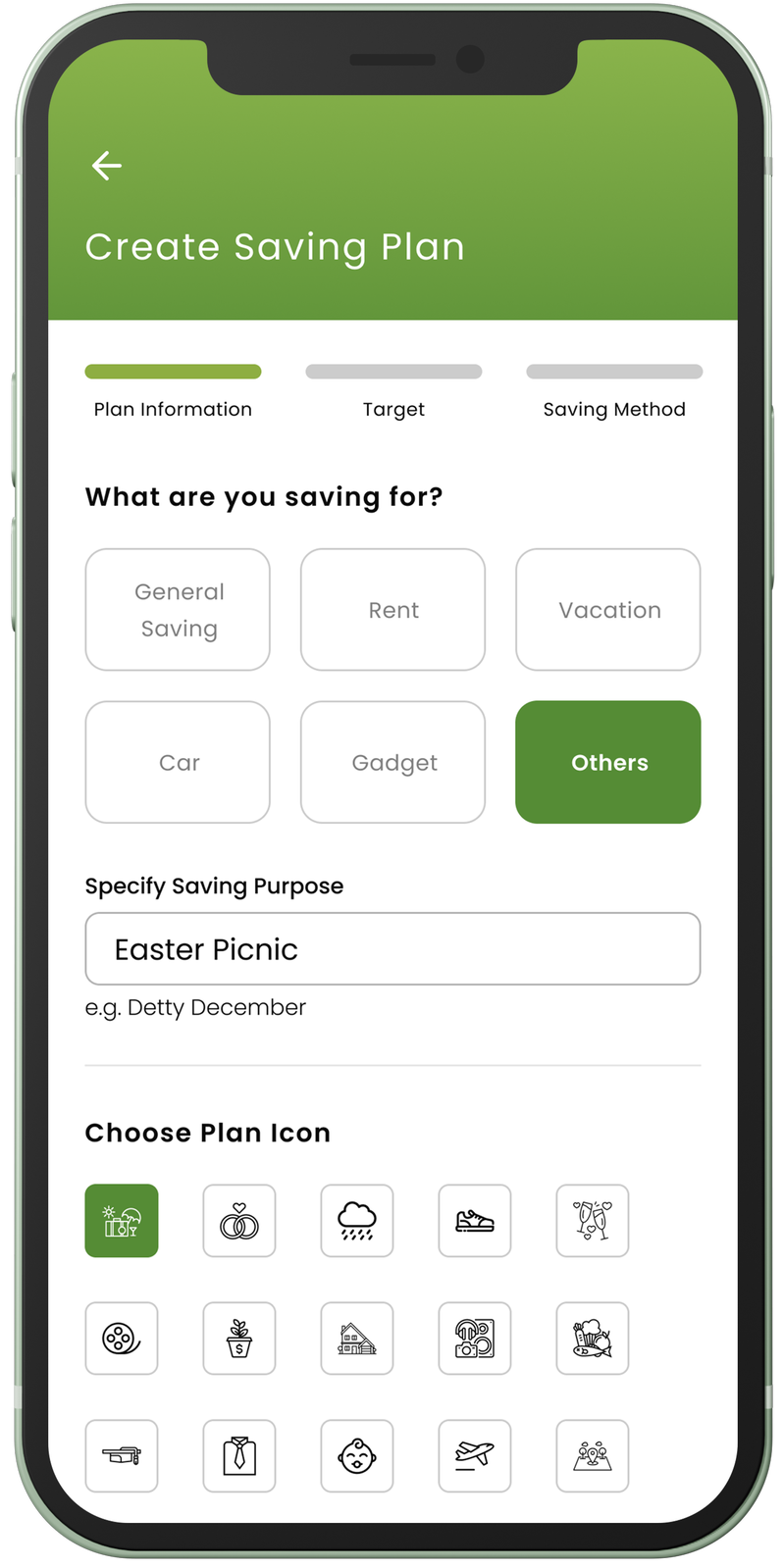

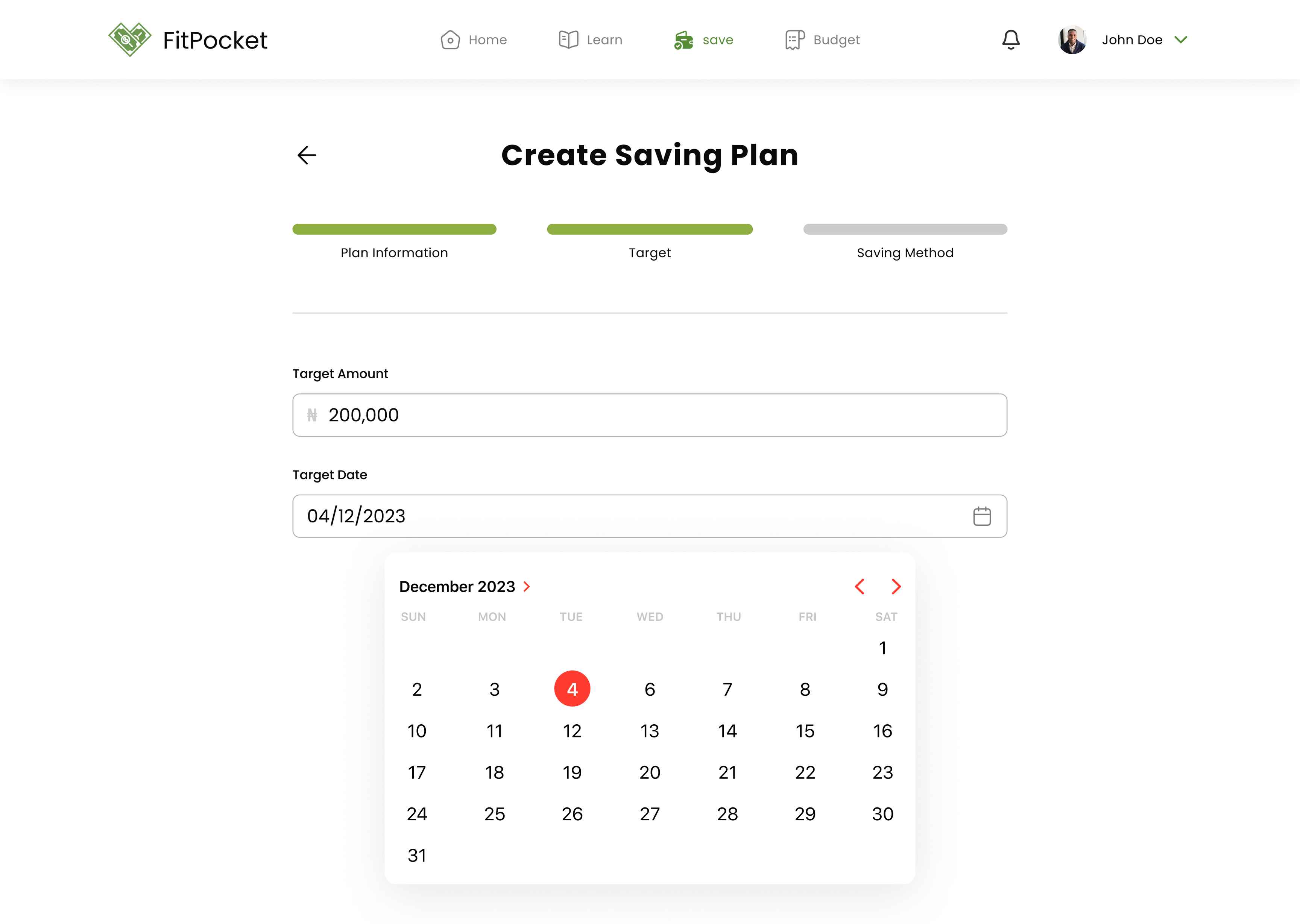

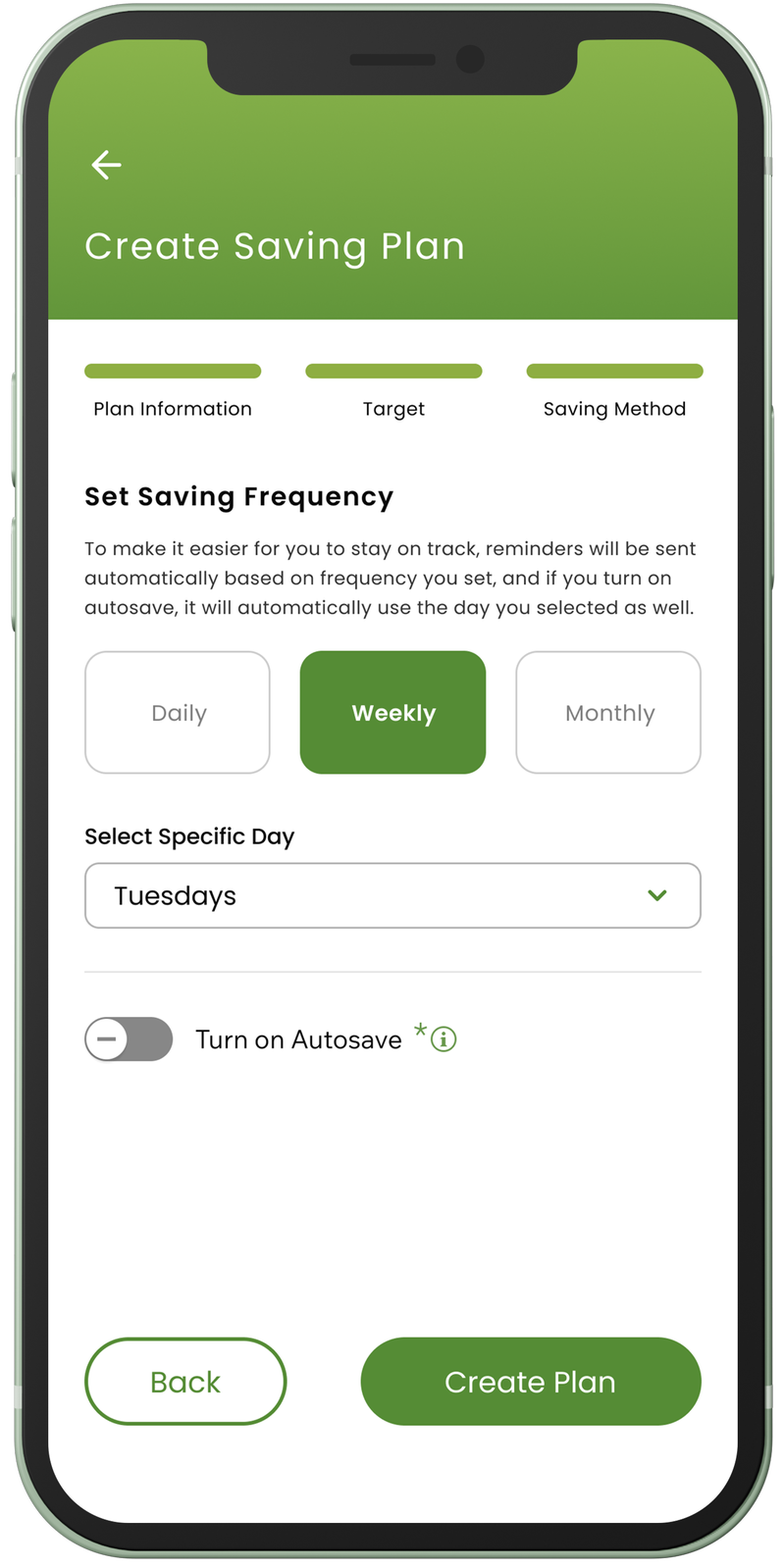

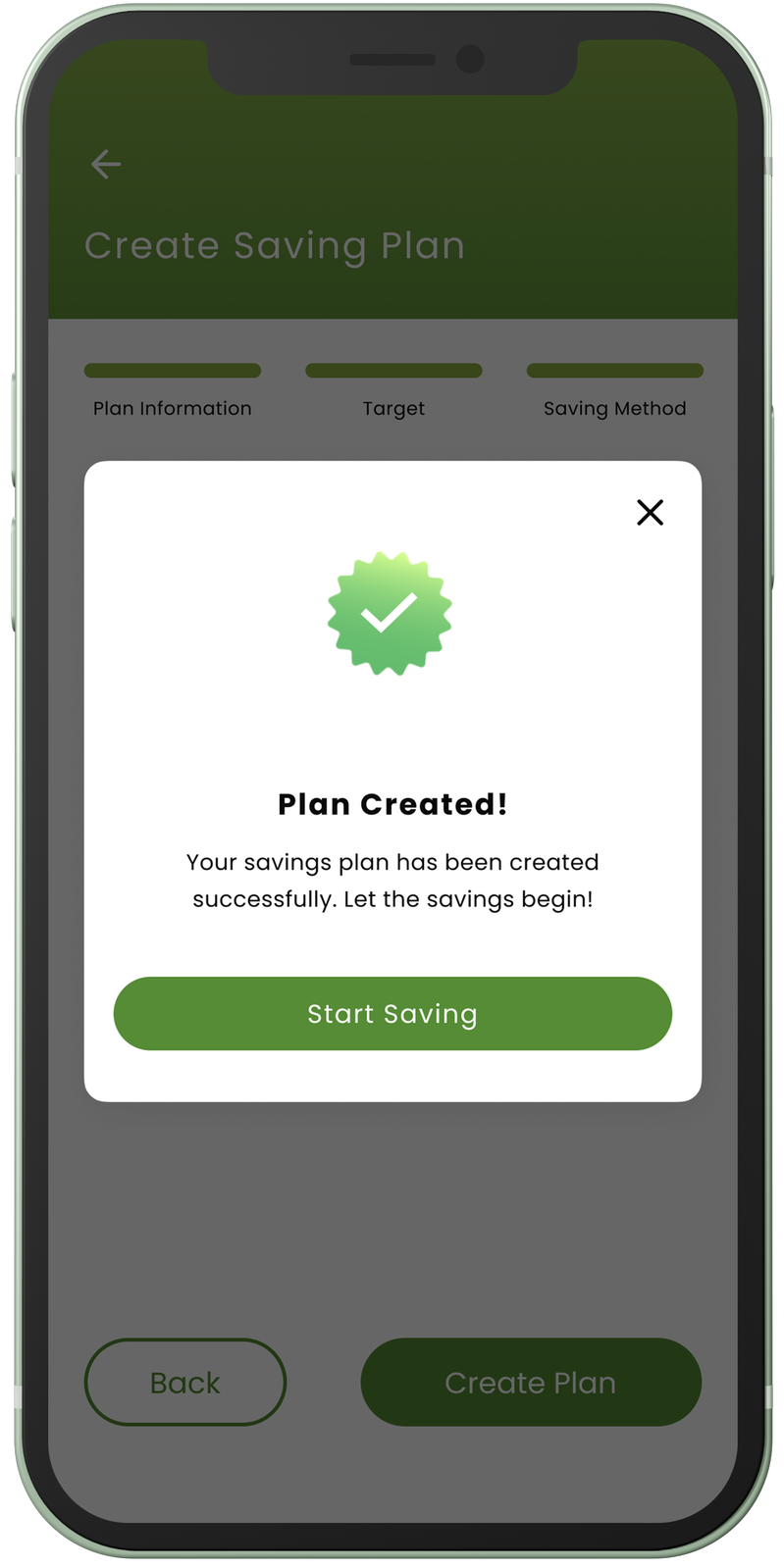

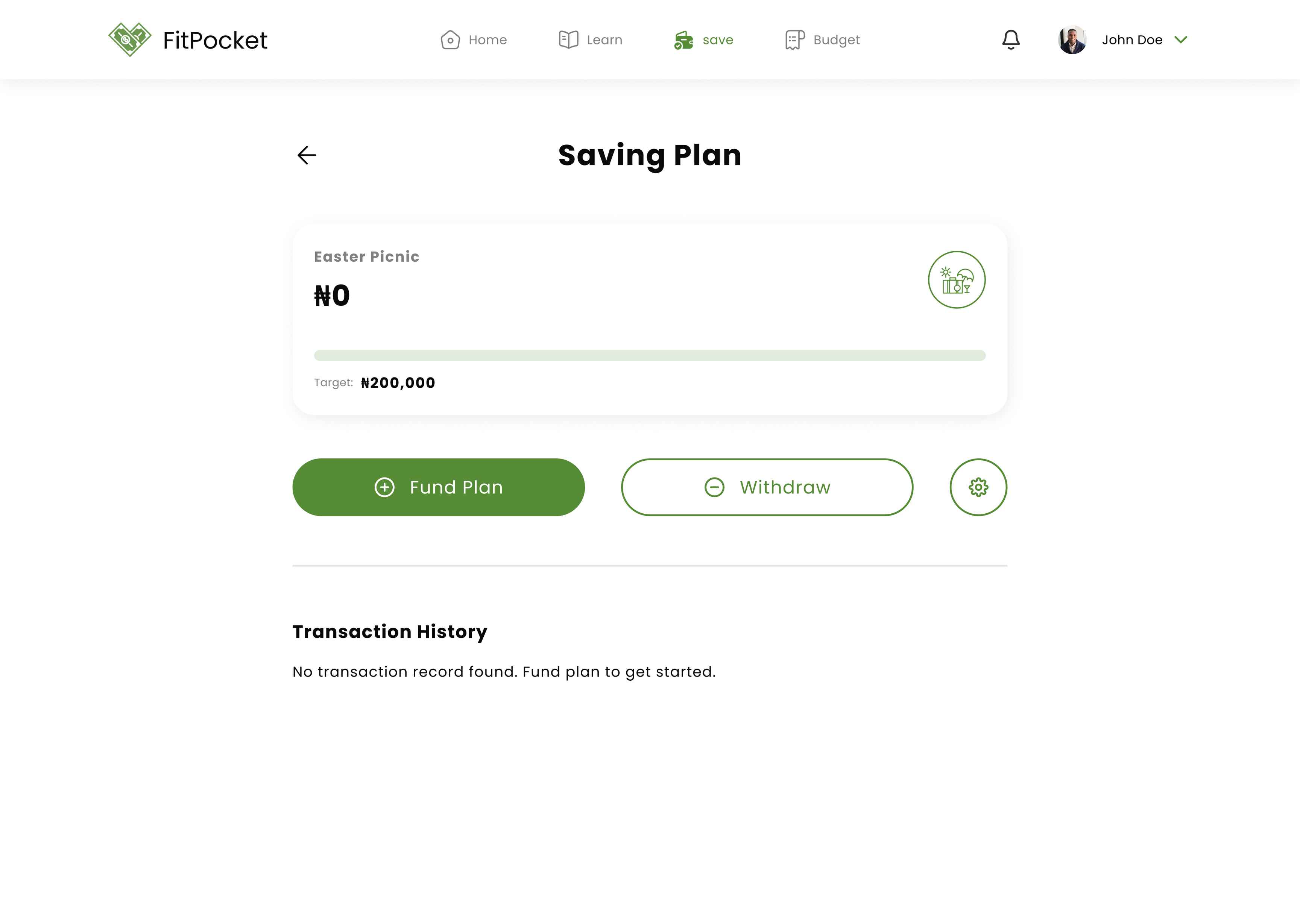

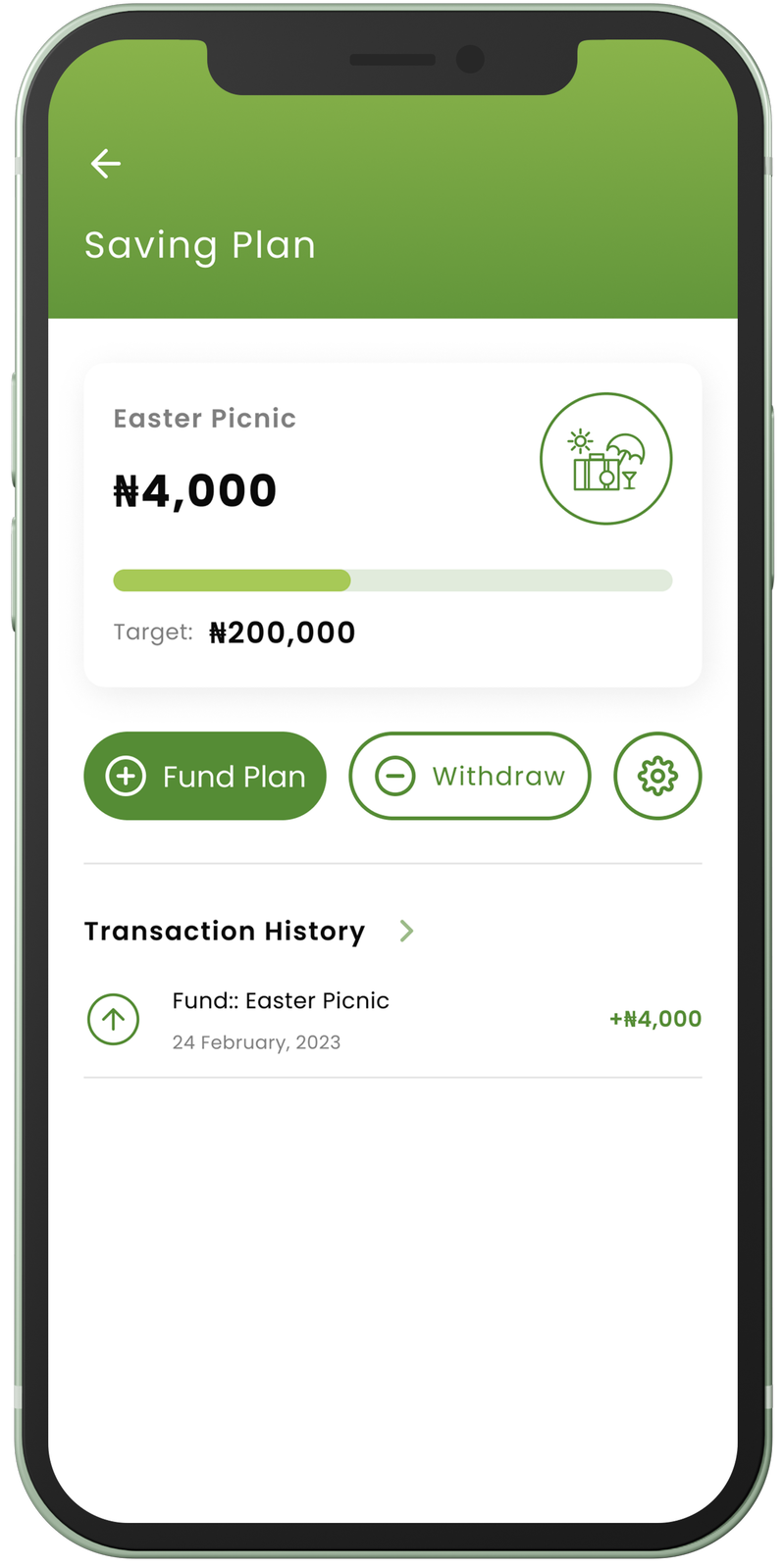

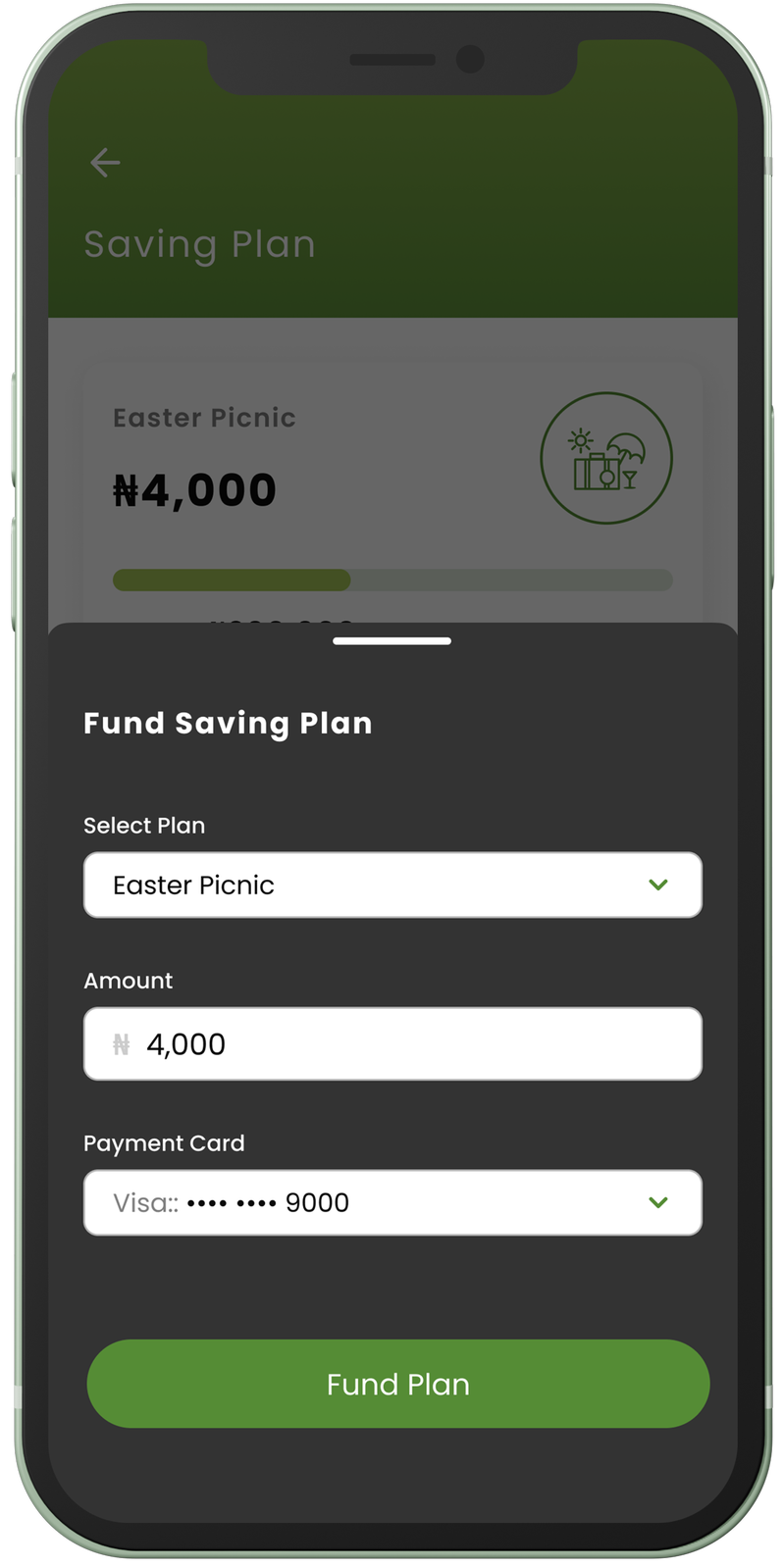

Users have the opportunity to develop positive financial habits and apply the concepts they learn by utilizing the in-app saving feature.

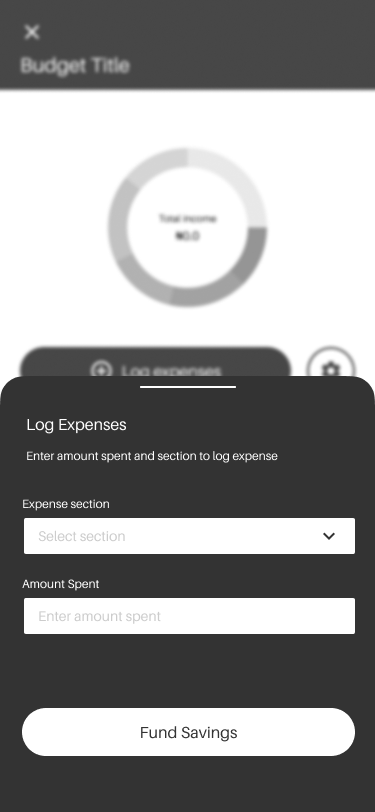

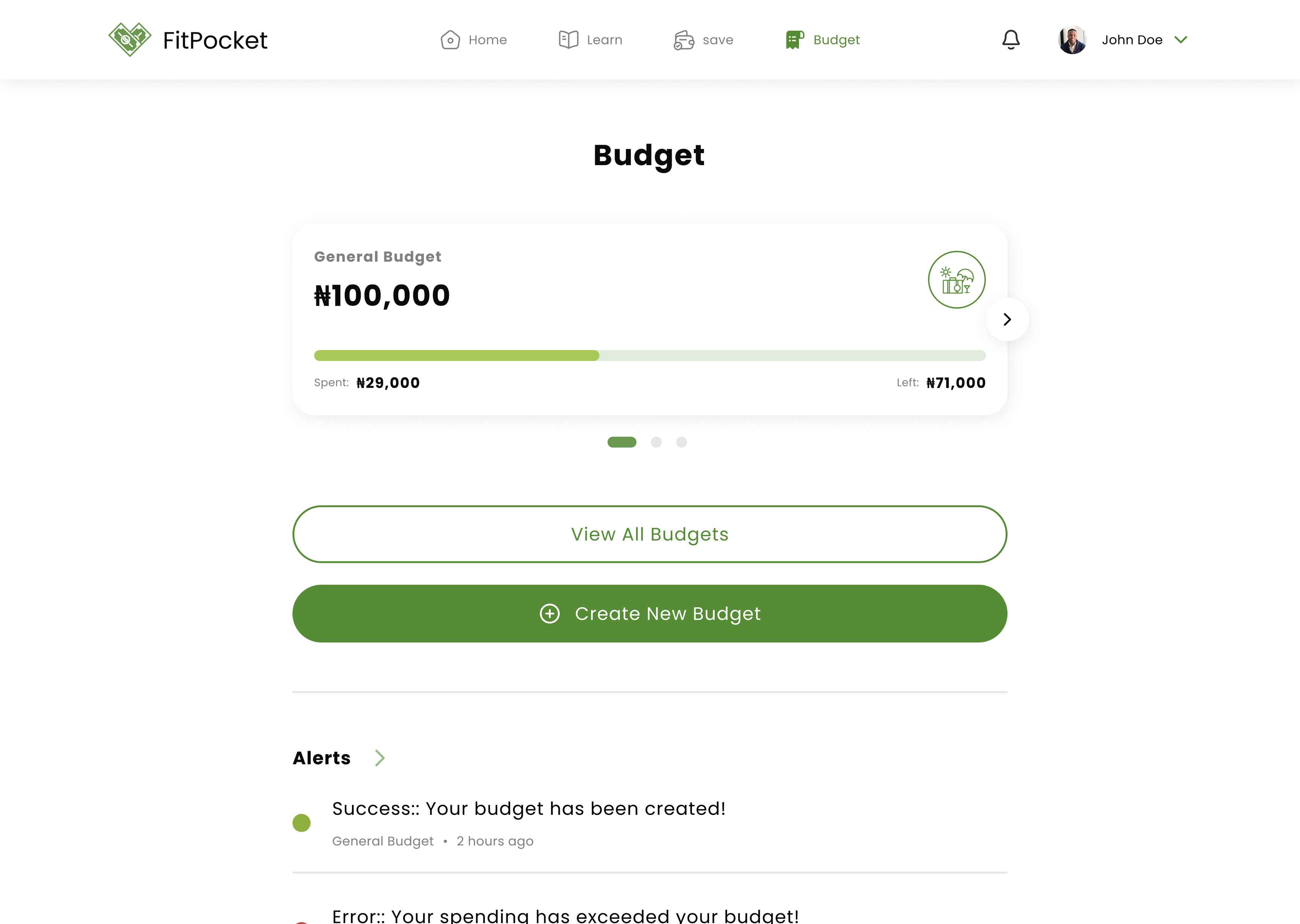

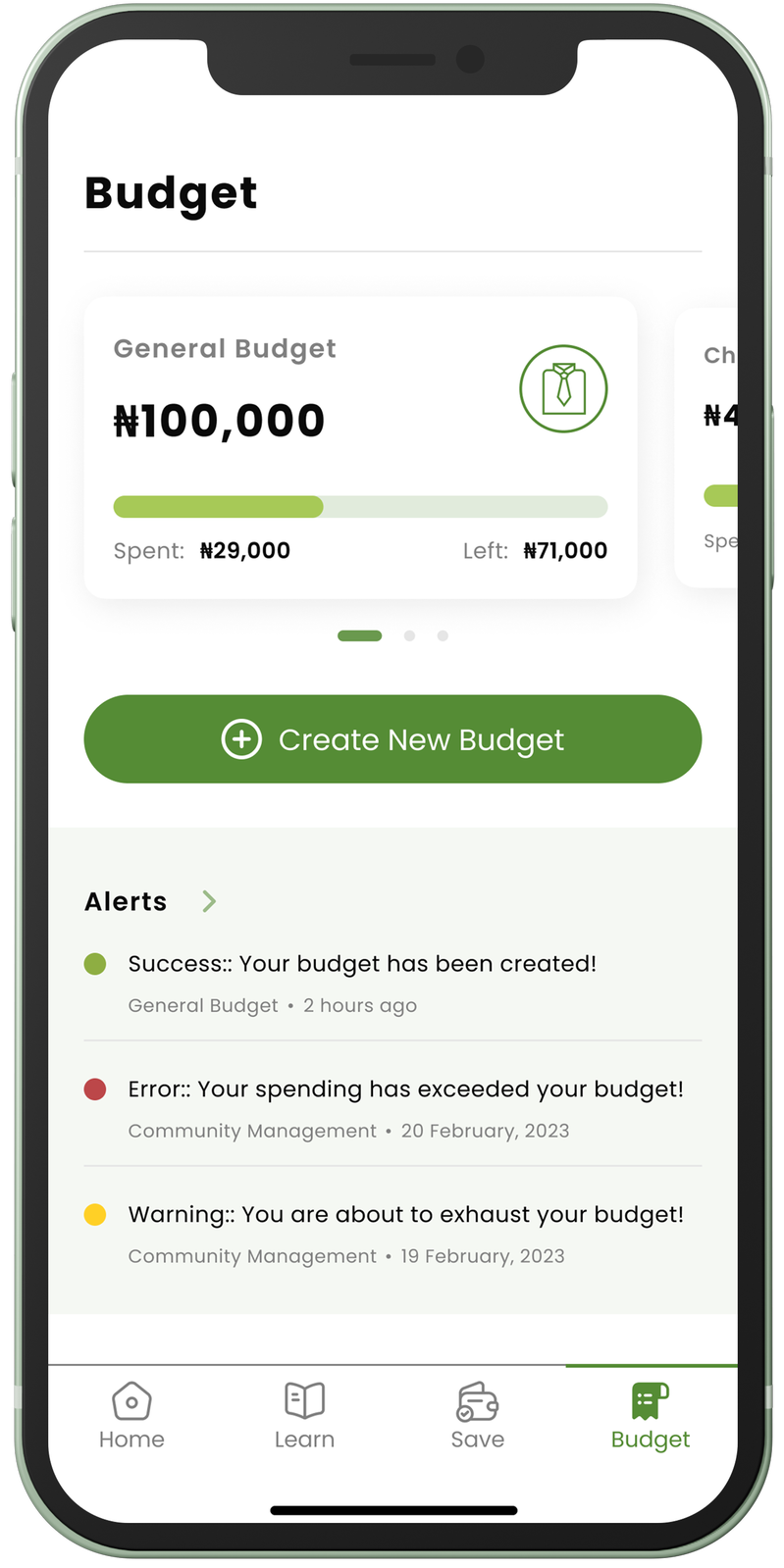

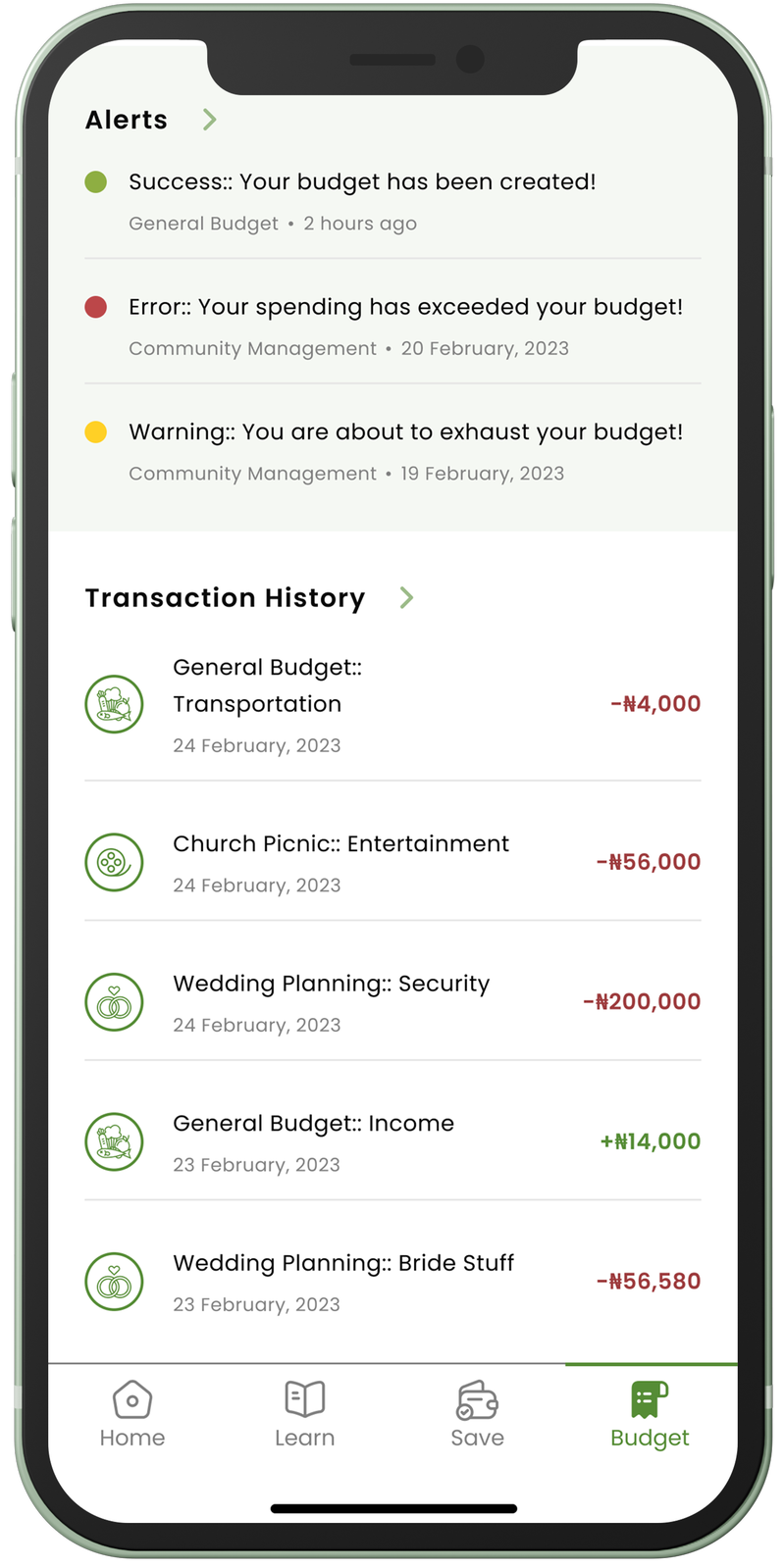

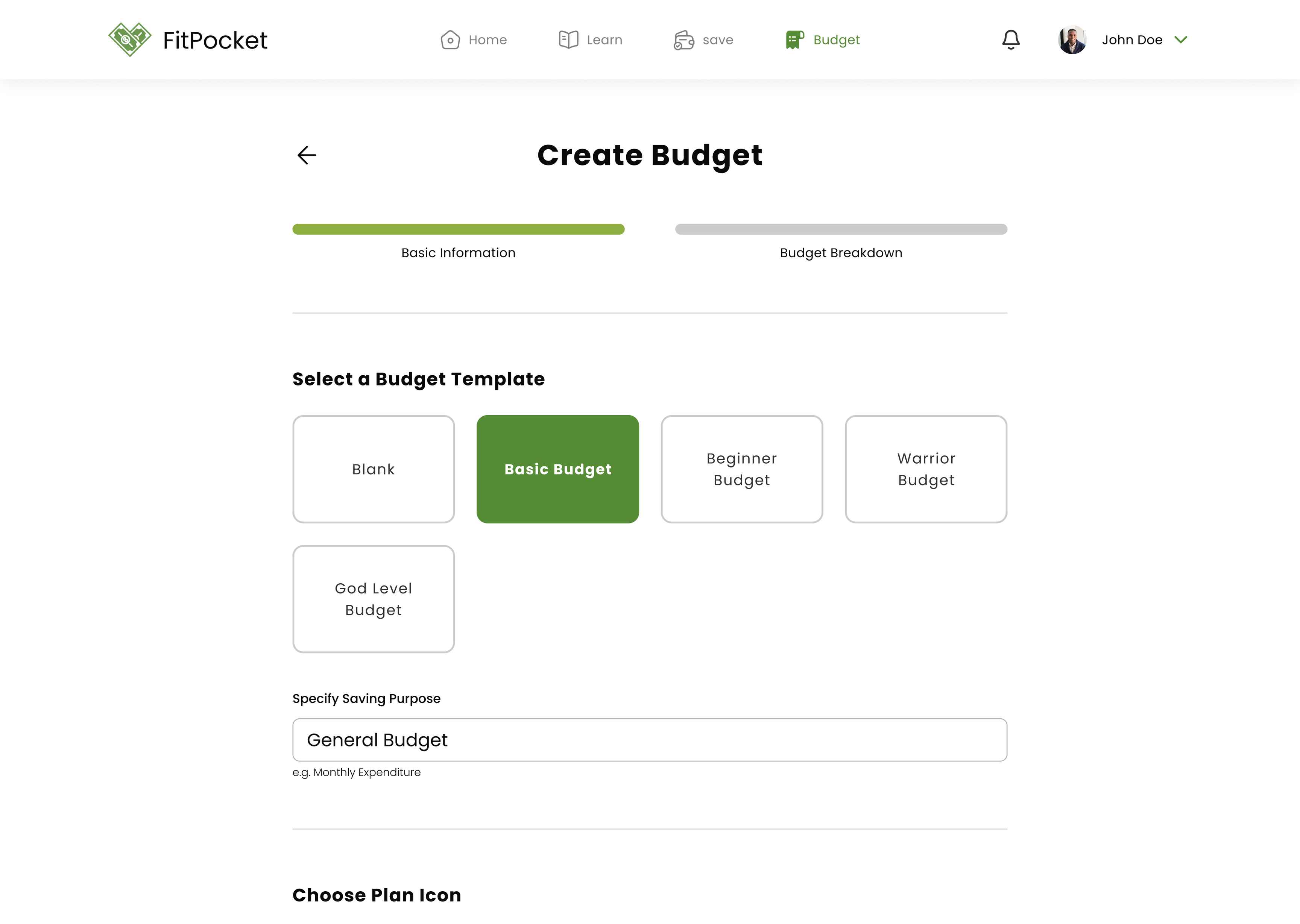

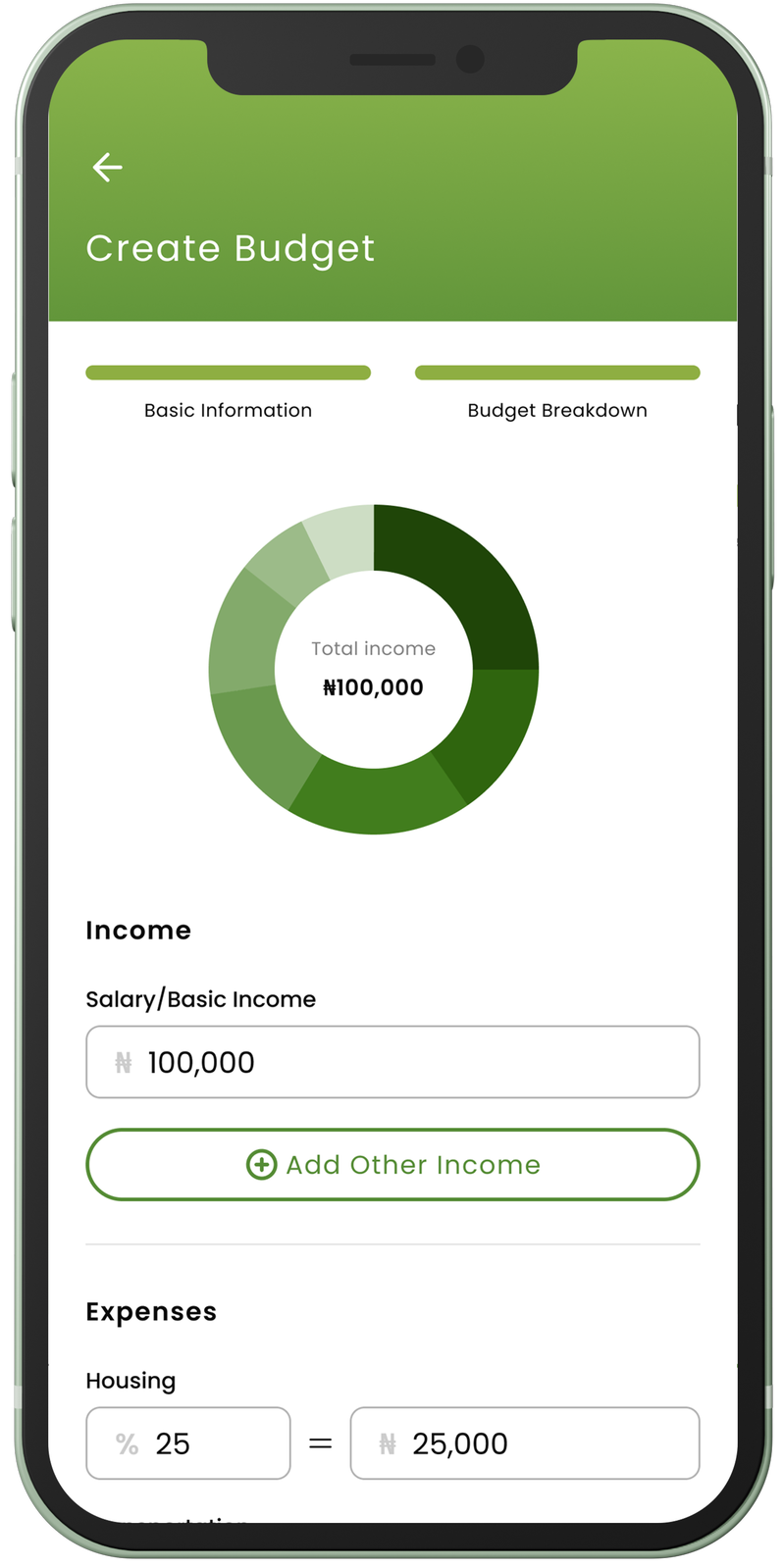

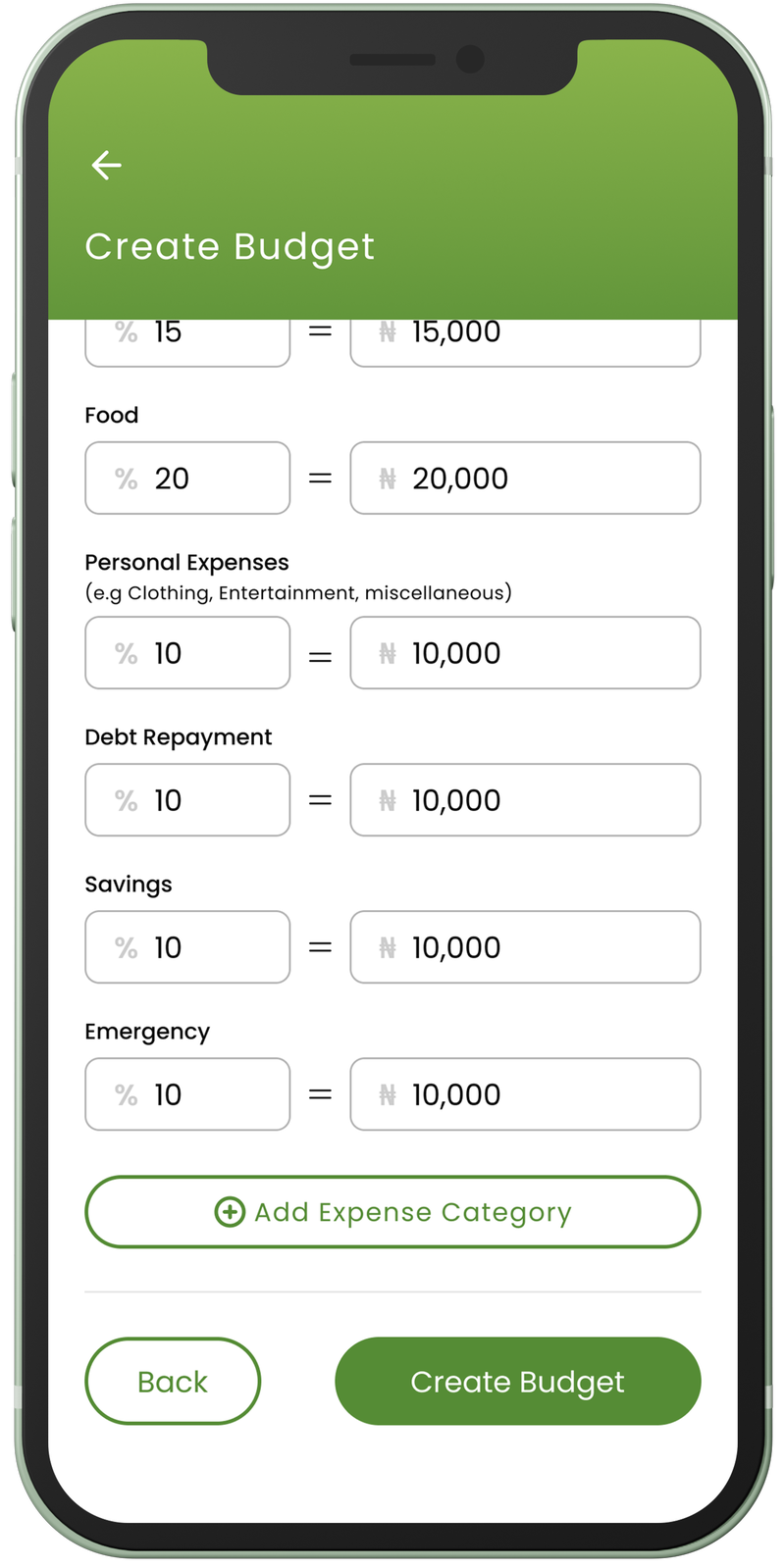

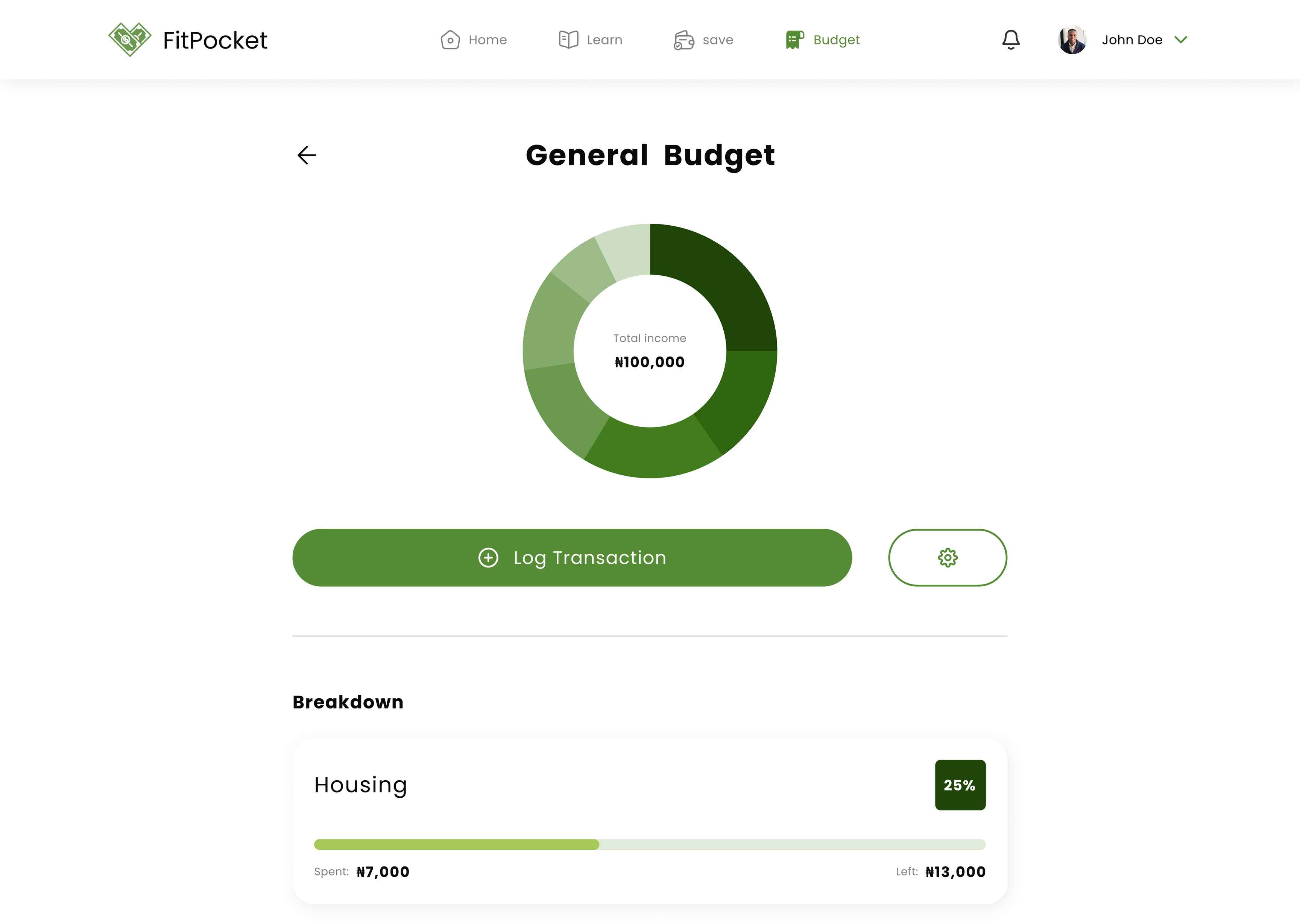

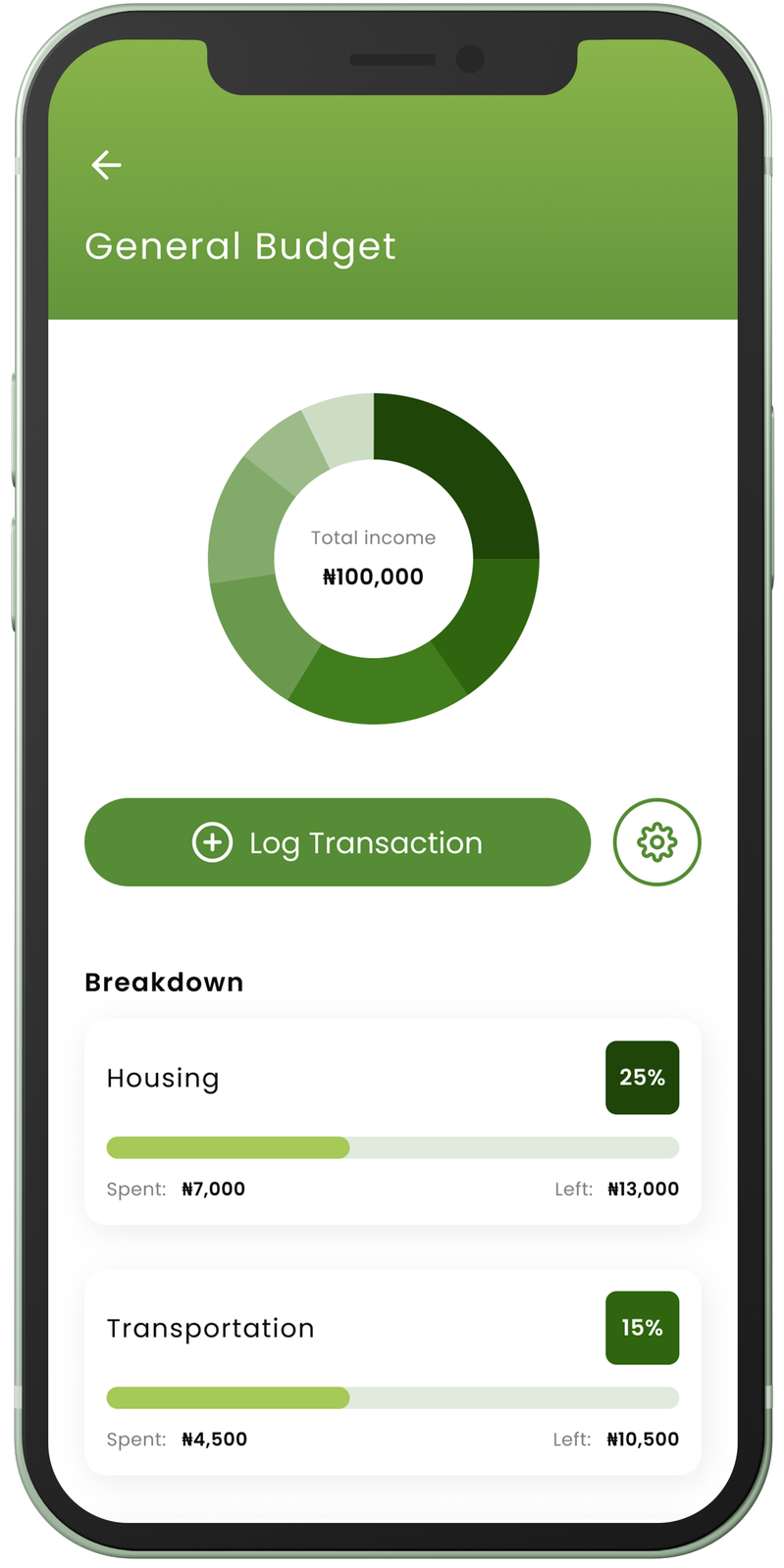

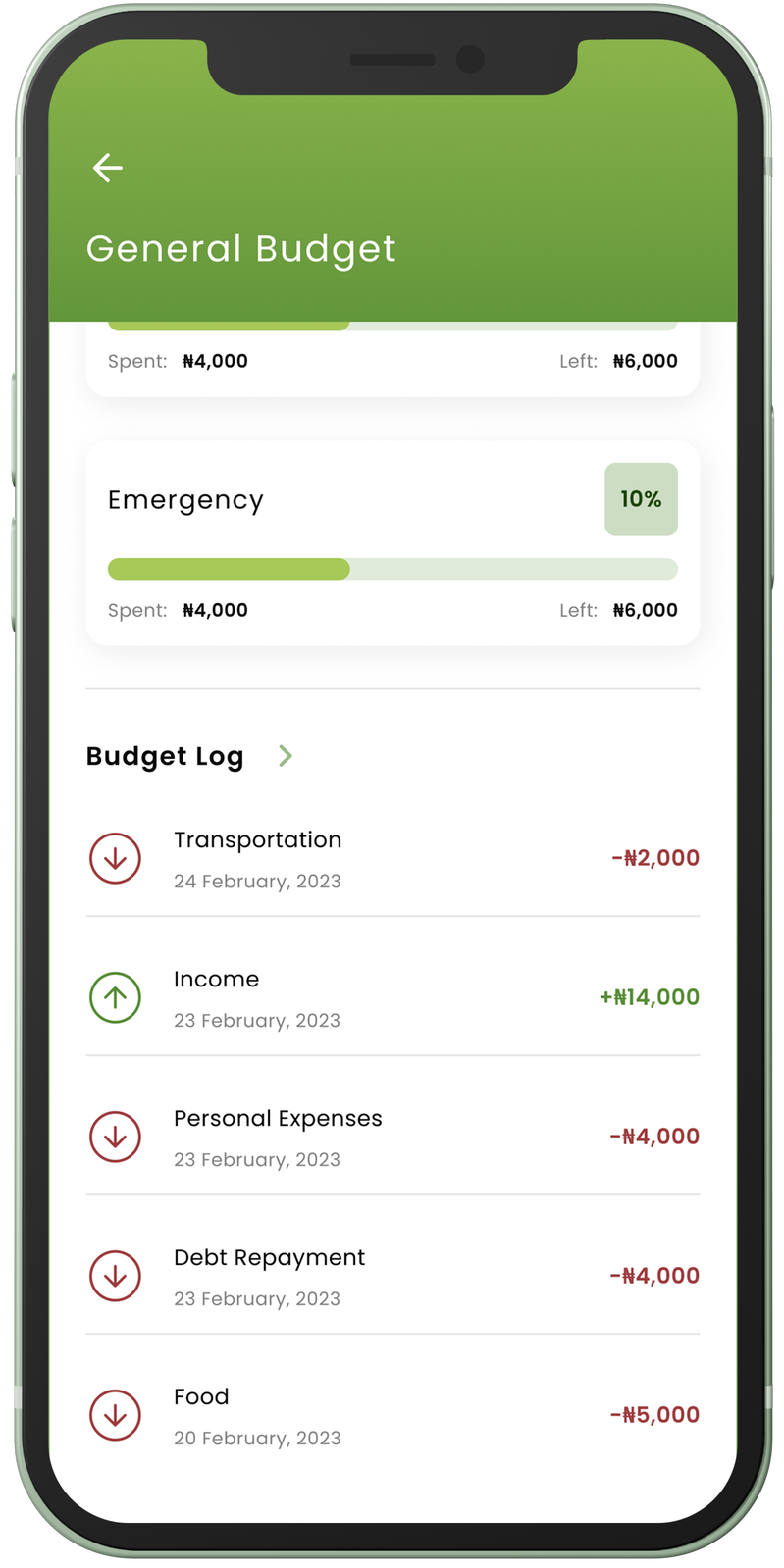

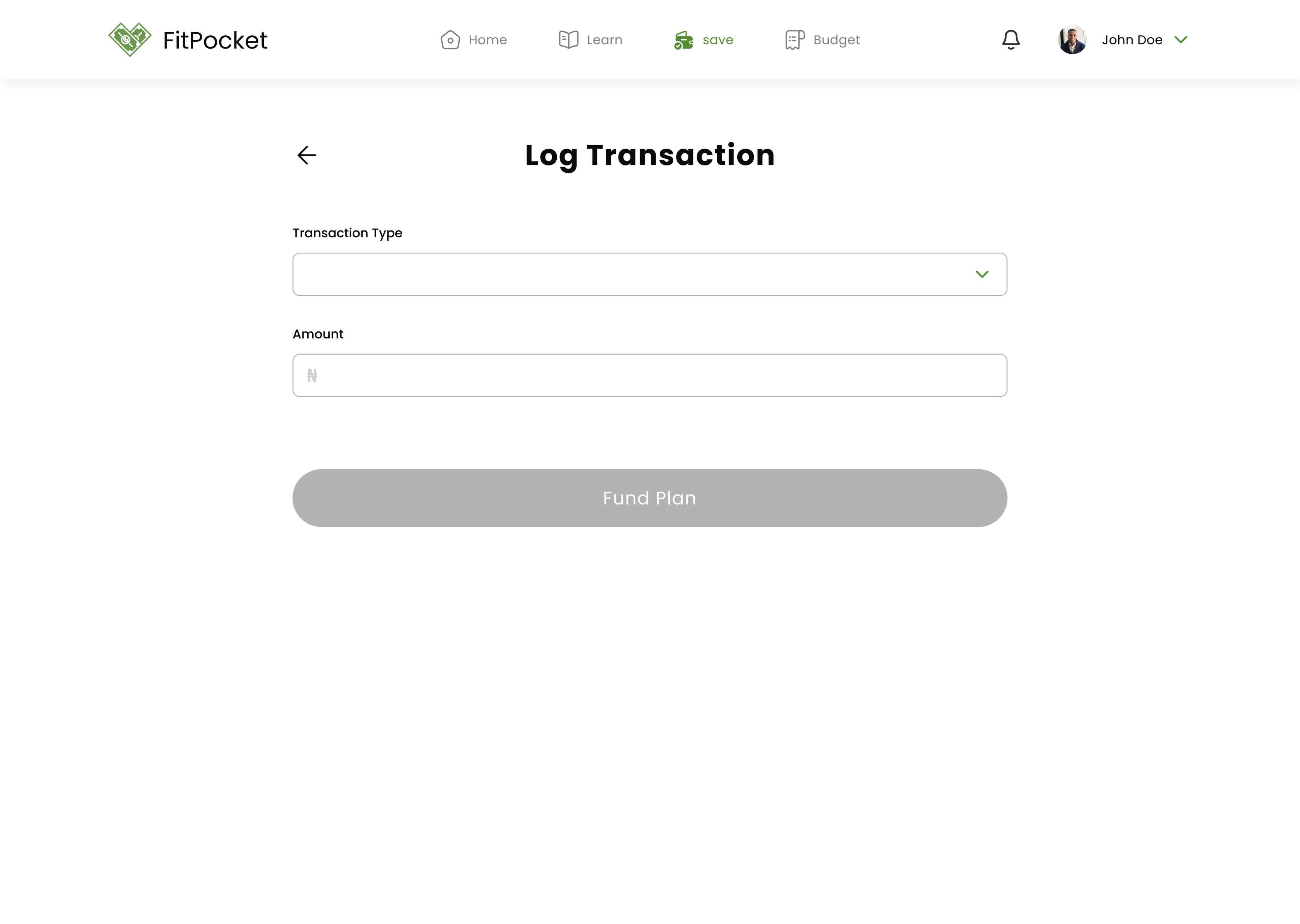

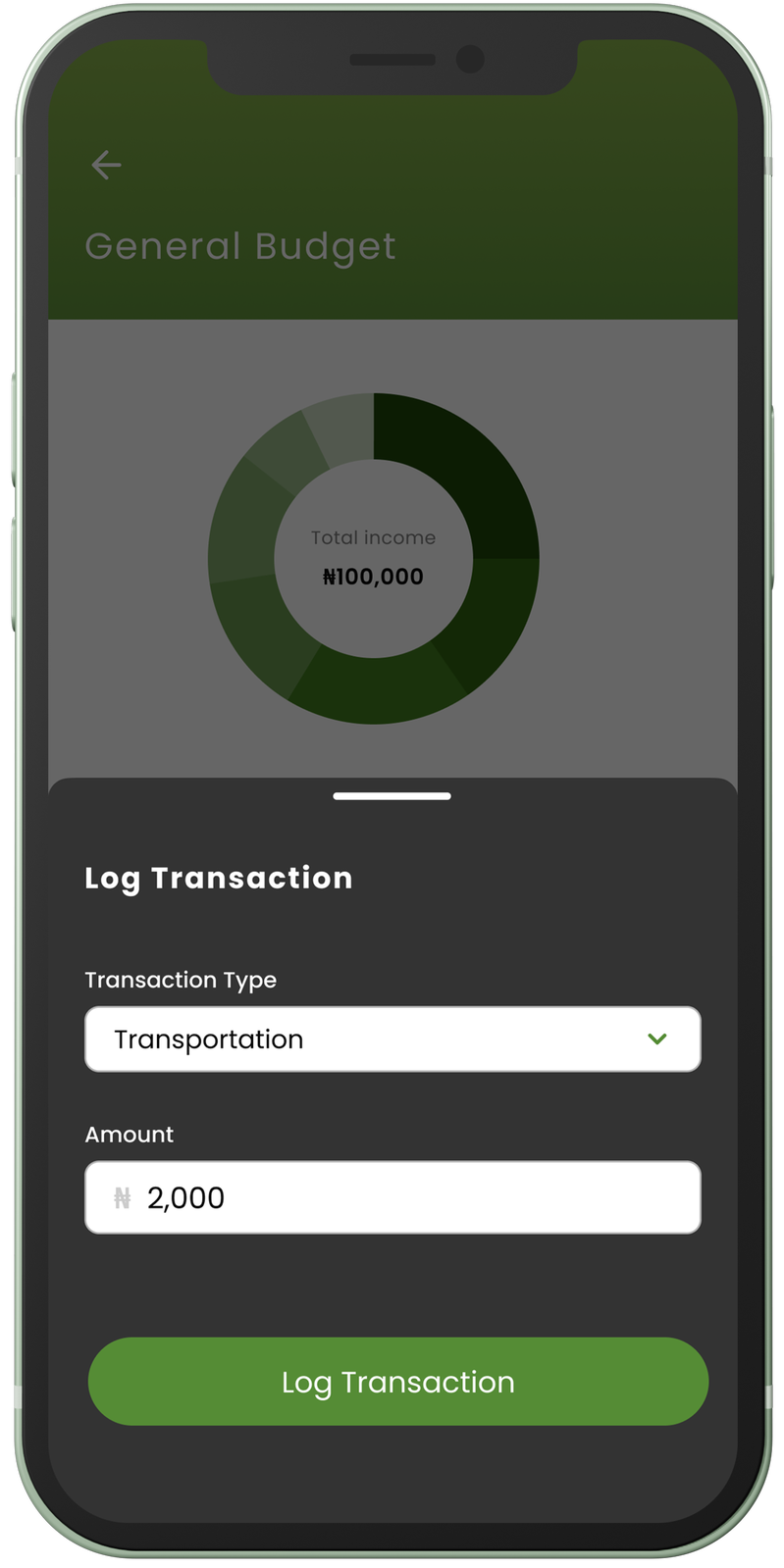

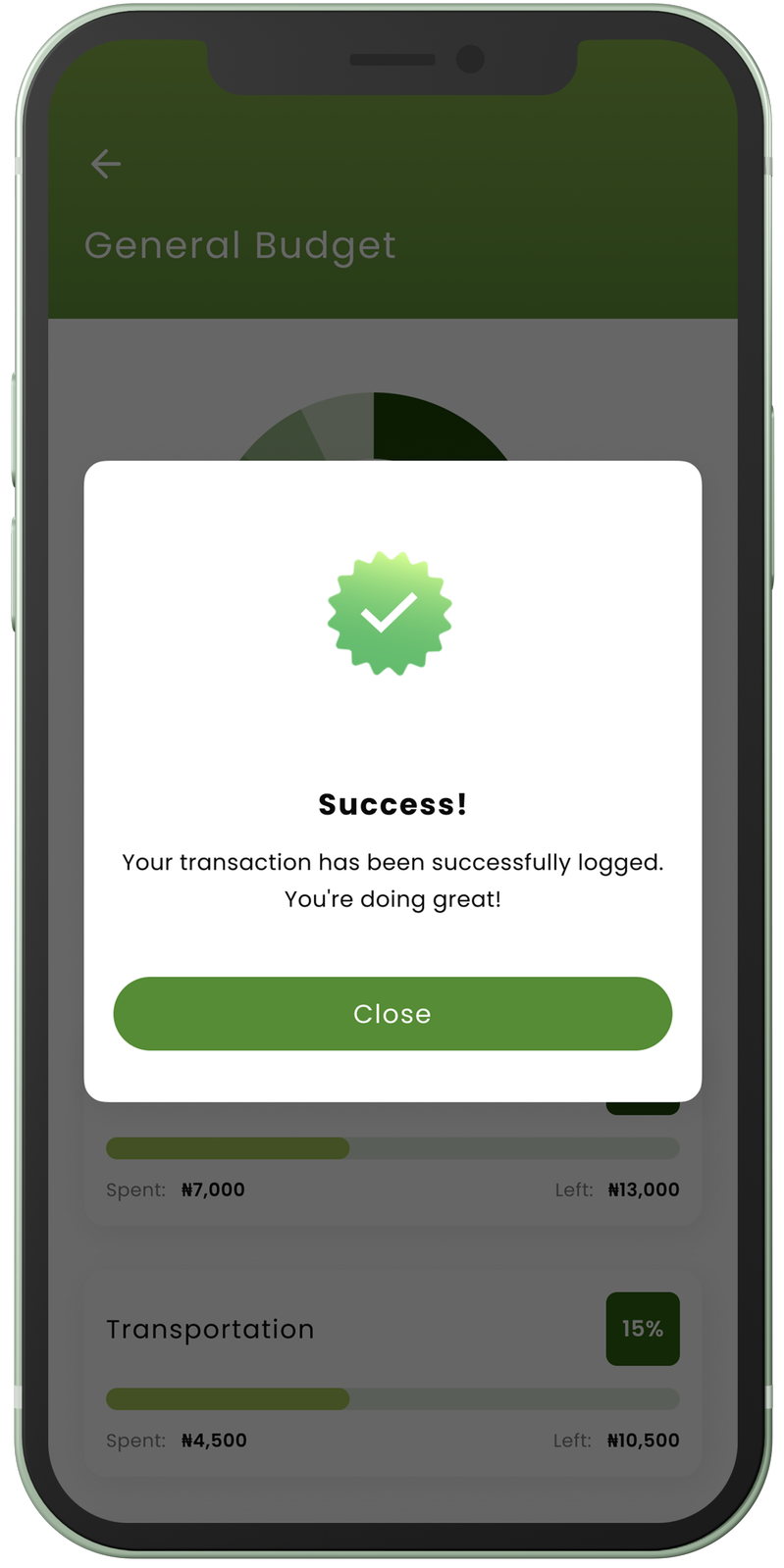

Our budgeting feature empowers users to establish budgets from scratch or templates, and efficiently monitor their adherence to the budget through the logging of expenses and incomes.

After completing the app, a second round of usability studies was conducted to gather user feedback on the mobile and web designs, identifying any potential issues that could hinder task performance.

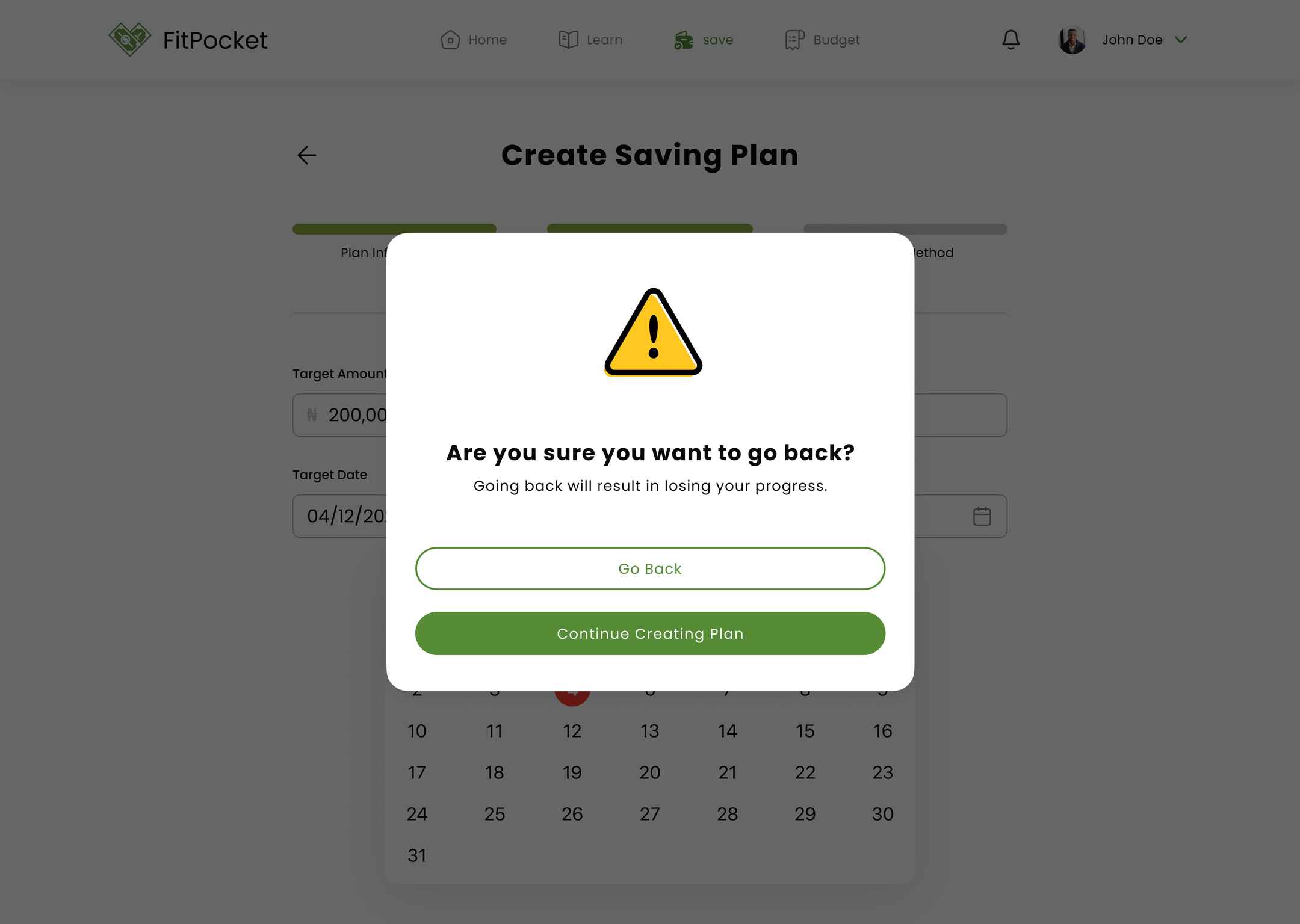

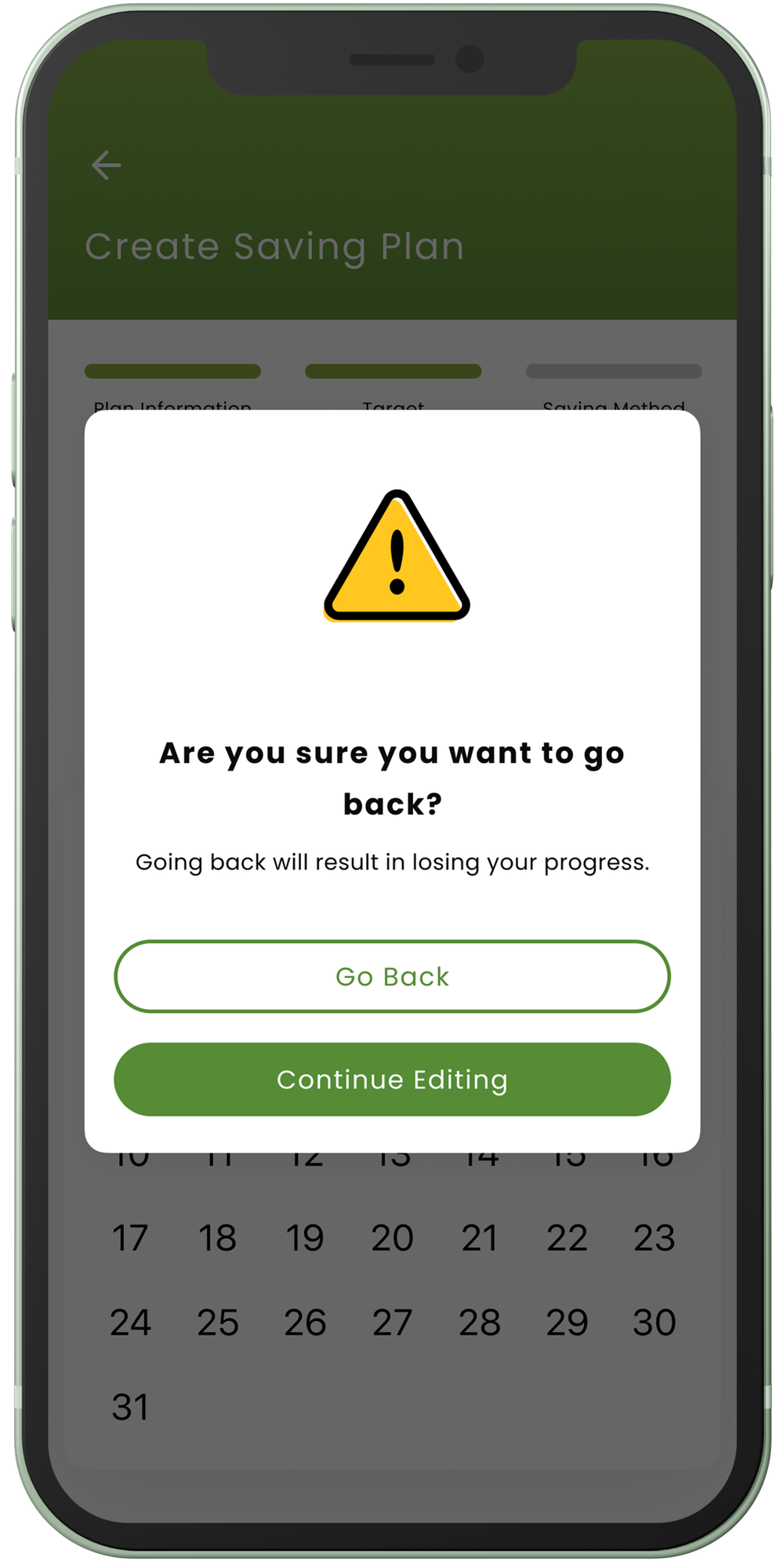

Users reported losing their progress while executing certain tasks due to the confusion between the back button and "return to the previous stage." To address this issue, a warning overlay was developed to notify users of destructive actions.